2019 Tax Bracket Earned Income Credit 2019 Chart

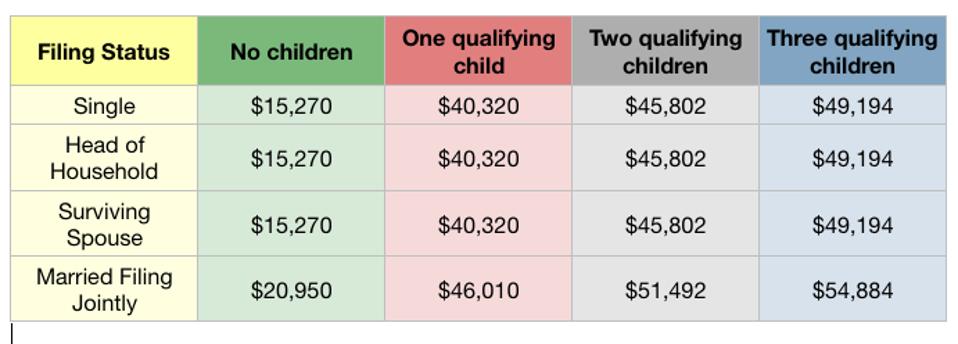

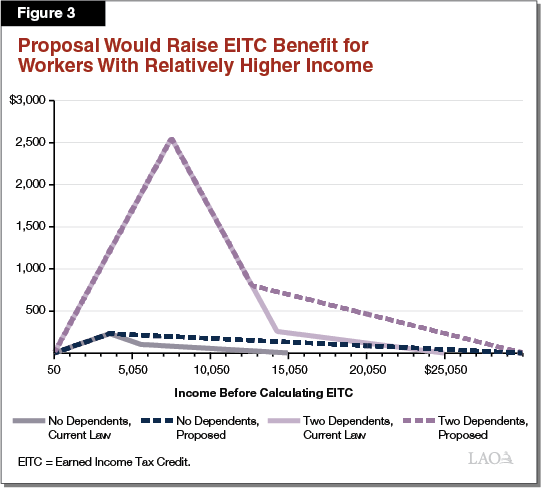

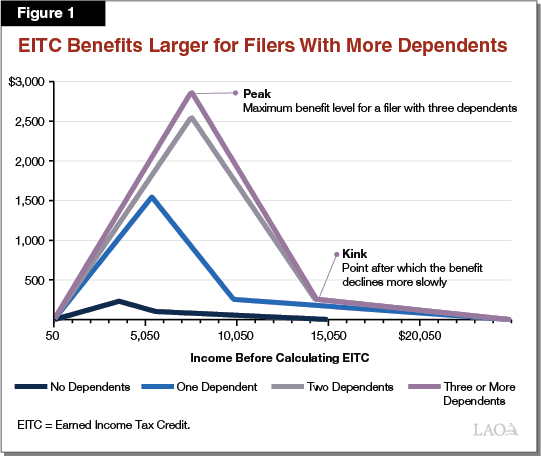

The maximum earned income tax credit in 2019 for single and joint filers is 529 if the filer has no children table 5.

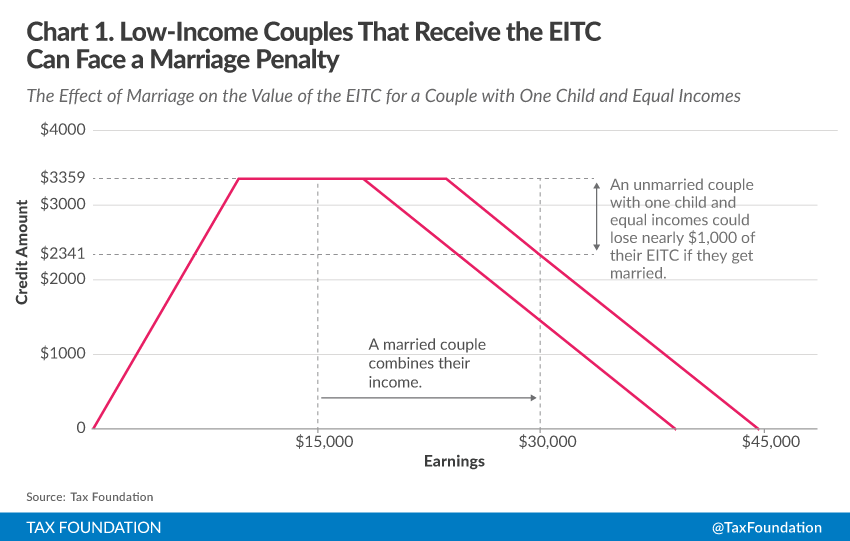

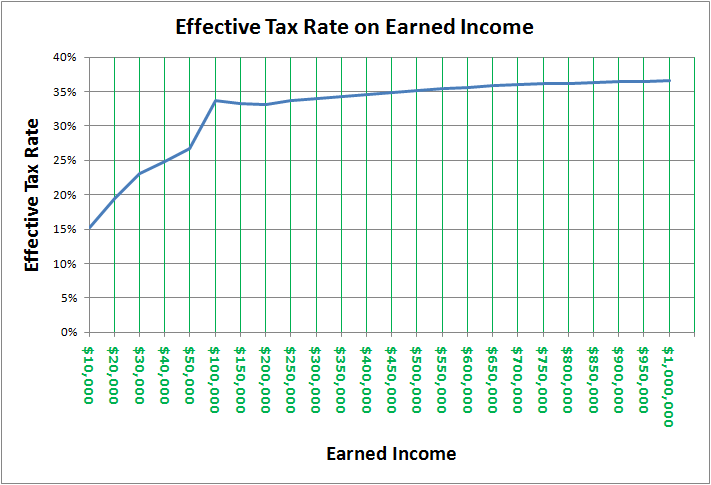

2019 tax bracket earned income credit 2019 chart. All these are relatively small increases from 2018. The earned income tax credit eitc or eic is a benefit for working people with low to moderate income. 10 12 22 24 32 35 and 37.

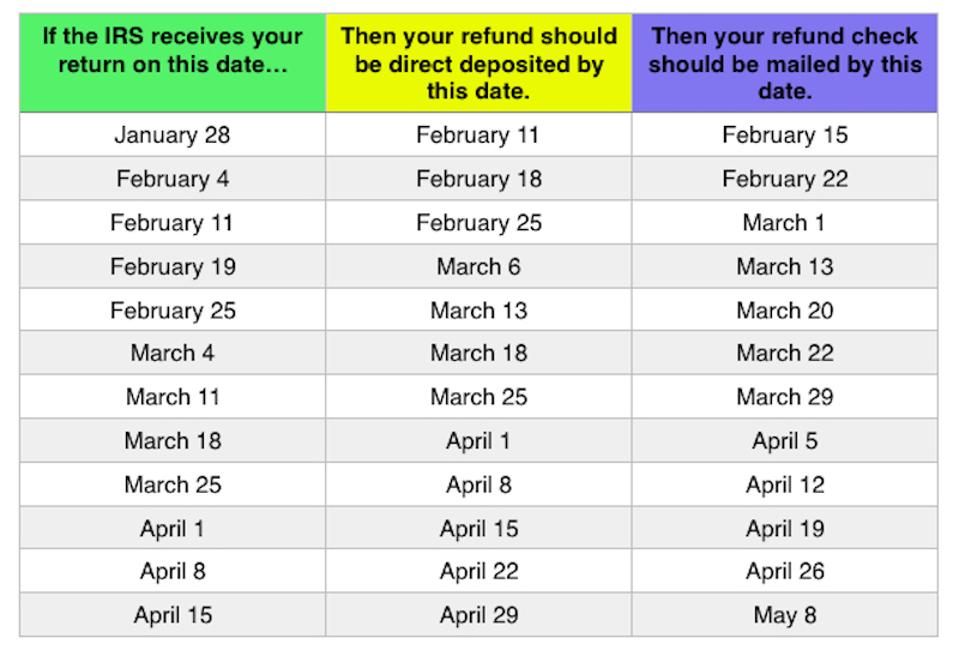

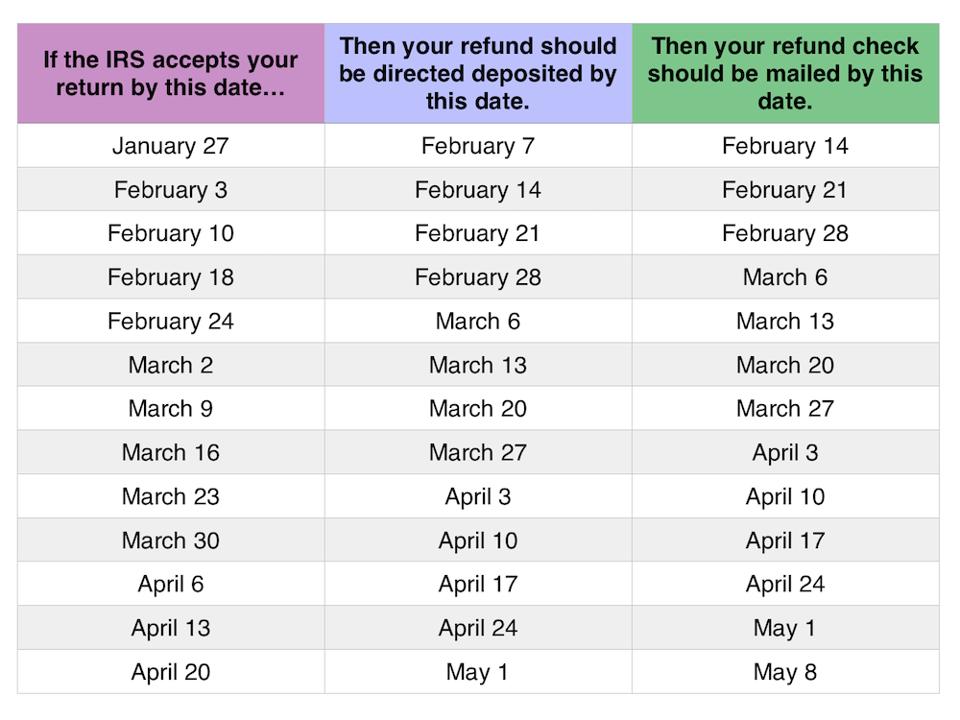

Certain rules for income earned during 2019. 3 526 with one qualifying child. At least but less than singlemarried ling jointly married ling sepa rately head of a house hold your taxis 25 200 25 250 25 300 25 350 2 833 2 839 2 845 2 851 sample table 25 250 25 300 25 350 25 400 2 639 2 645 2 651 2 657 2 833.

2019 earned income credit 50 wide brackets 6 12 19 if the if the if the amount you and you listed amount you and you listed amount you and you listed are looking up are looking up are looking up. 2019 earned income credit 50 wide brackets 6 12 19 if the if the if the. 529 with no qualifying children.

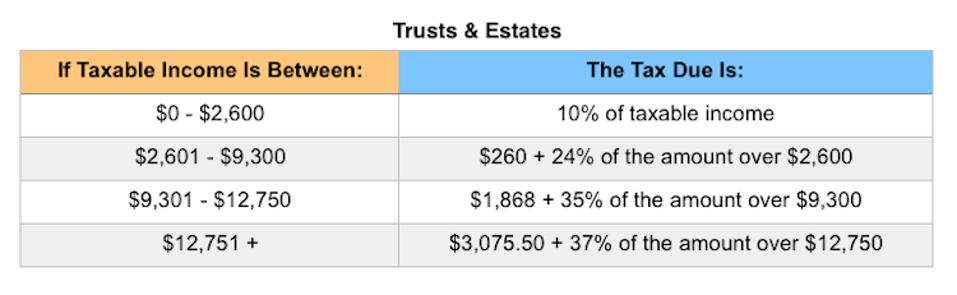

There are seven federal tax brackets for the 2020 tax year. Your total earned income must be at least 1. The earned income tax credit is available to claim for the 2019 2020 tax season.

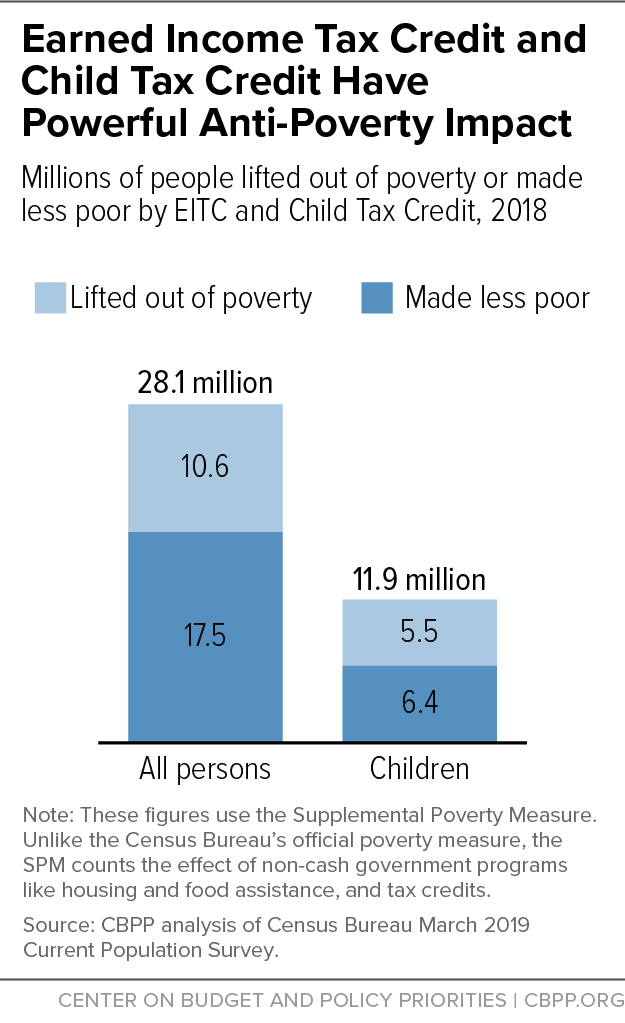

See the instructions for line 12a to see if you must use the tax table below to figure your tax. In some cases the eic can be greater than your total income tax bill providing an income tax refund to families that. Earned income credit eic is a tax credit available to low income earners.

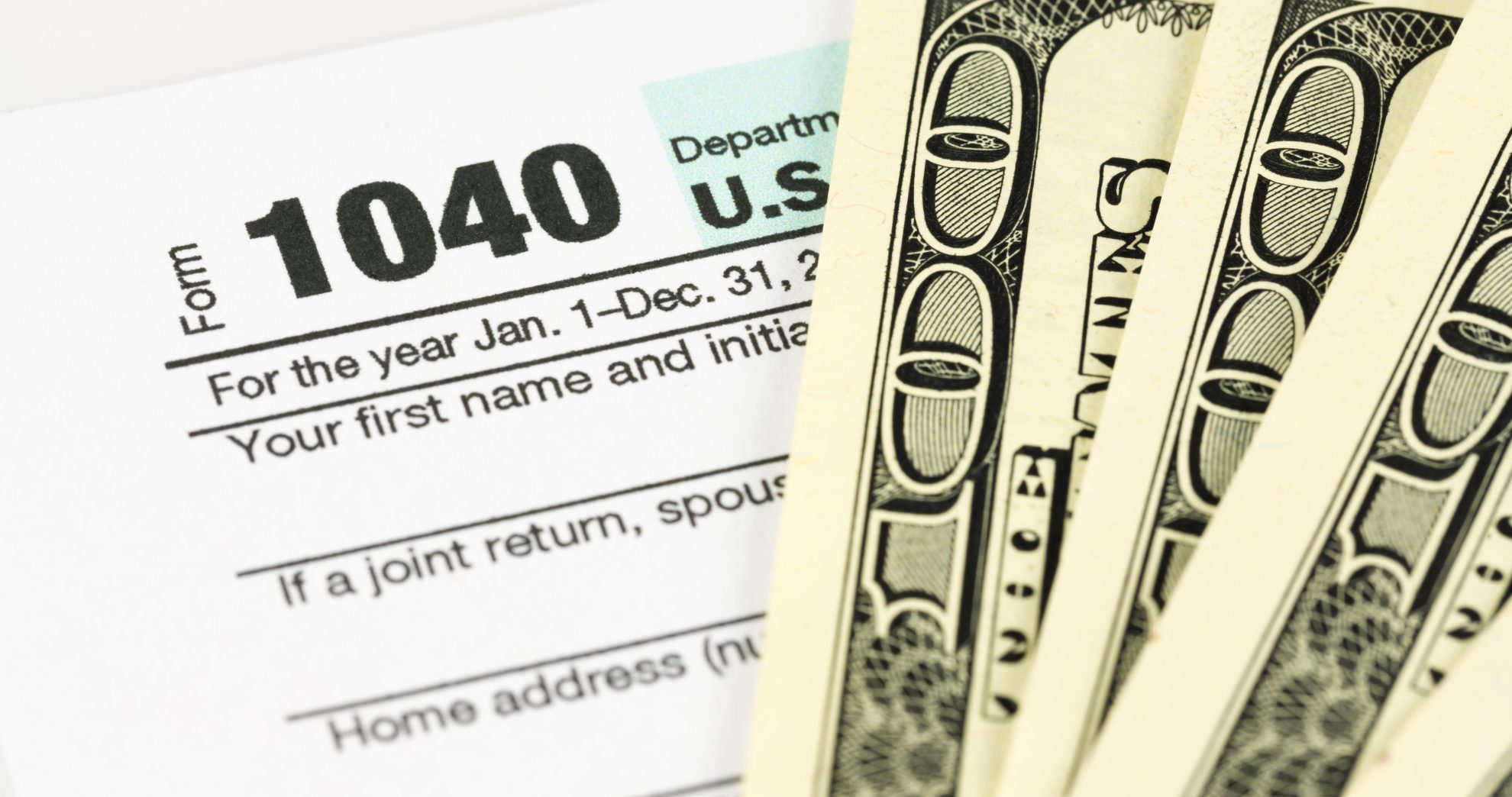

The maximum amount of credit for tax year 2019 is. Your tax year investment income must be 3 600 or less for the year. To qualify you must meet certain requirements and file a tax return even if you do not owe any tax or are not required to file.

1040 tax and earned income credit tables introductory material 1040 tax and earned income credit tables main contents tax table skip to main content an official website of the united states government. See the instructions for line 12a to see if you must use the tax table below to figure your tax. Must not file form 2555 foreign earned income or form 2555 ez foreign earned income exclusion.

Both your earned income and adjusted gross income agi must be no more than. 2019 tax table. Your bracket depends on your taxable income and filing status.

6 557 with three or more qualifying children. Stay informed on tax policy research and analysis. See the eic earned income credit table amounts and how you can claim this valuable tax credit.

2019 tax table k.

/cdn.vox-cdn.com/uploads/chorus_asset/file/16333756/eitc_trapezoid.png)

:max_bytes(150000):strip_icc()/ScreenShot2020-04-03at11.52.59AM-9d0f626d45704b75a451679182d740ef.png)

:max_bytes(150000):strip_icc()/TaxRates2-dc0366d01dd0491b91a1c3c93b4740db.jpg)

:max_bytes(150000):strip_icc()/2016-Federal-Tax-Rates-57a631ca3df78cf459194b33.png)

/cdn.vox-cdn.com/uploads/chorus_asset/file/19256127/838281776.jpg.jpg)

:max_bytes(150000):strip_icc():saturation(0.2):brightness(10):contrast(5)/Getty_family_dinner_talking_LARGE_TetraImages-5669d3ec5f9b583dc317dc11.jpg)