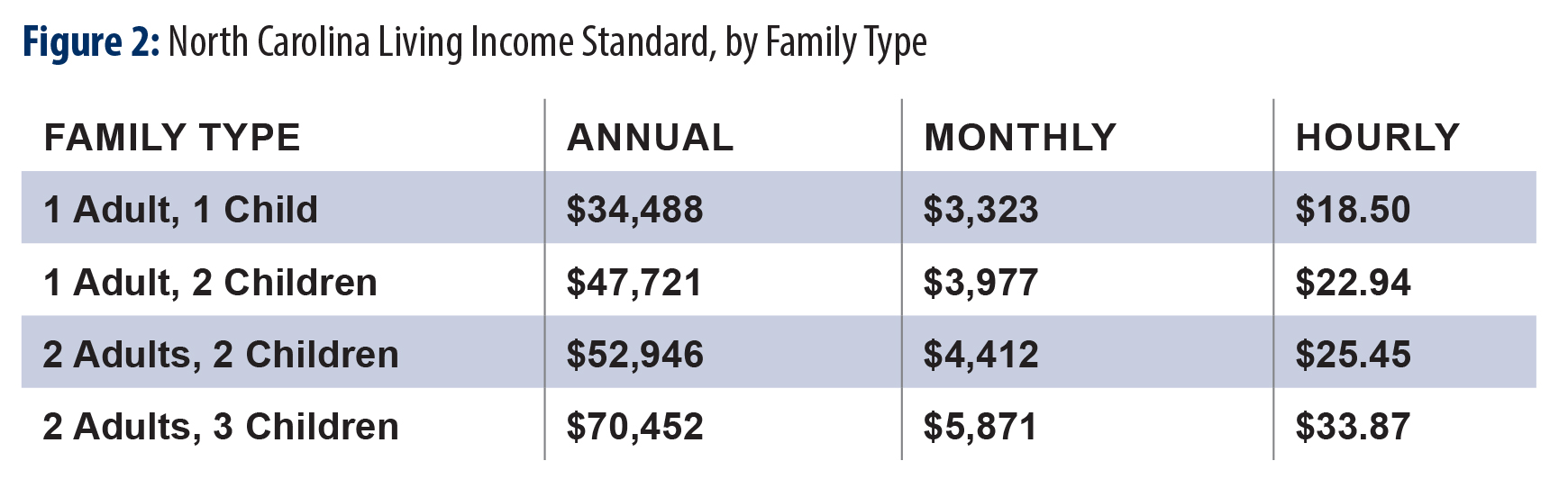

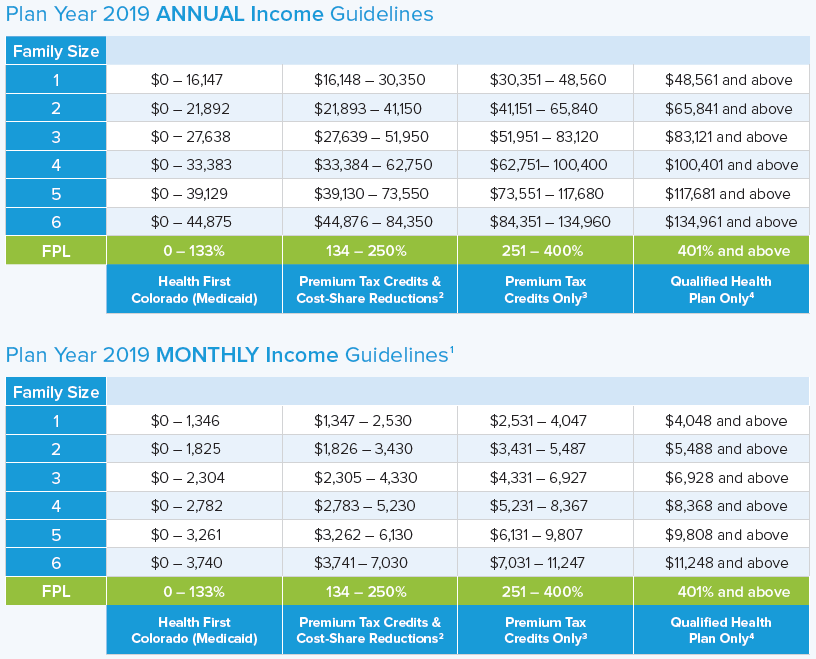

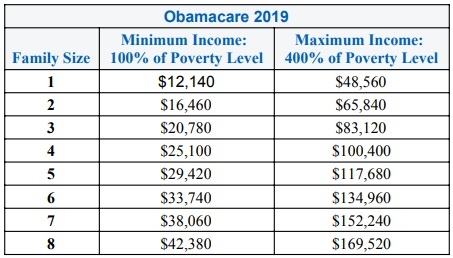

Obamacare Income Limits 2019 Chart

You can probably start with your household s adjusted gross income and update it for expected changes.

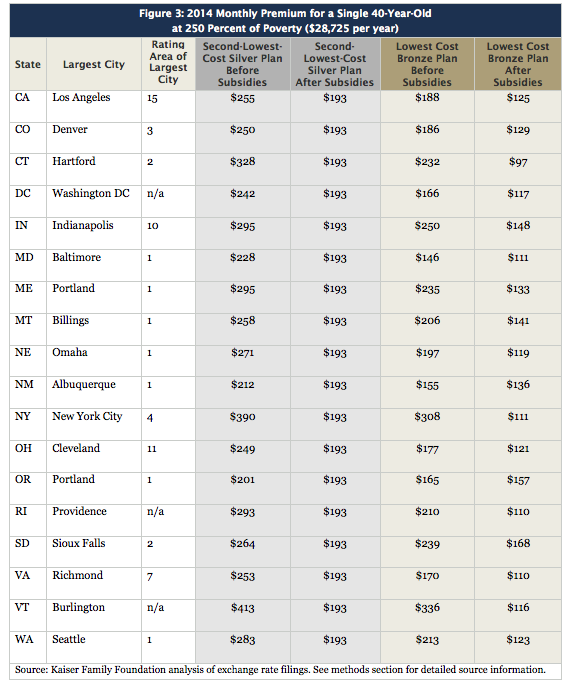

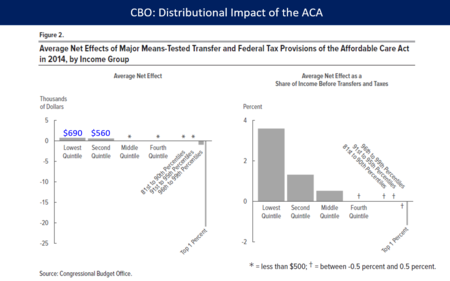

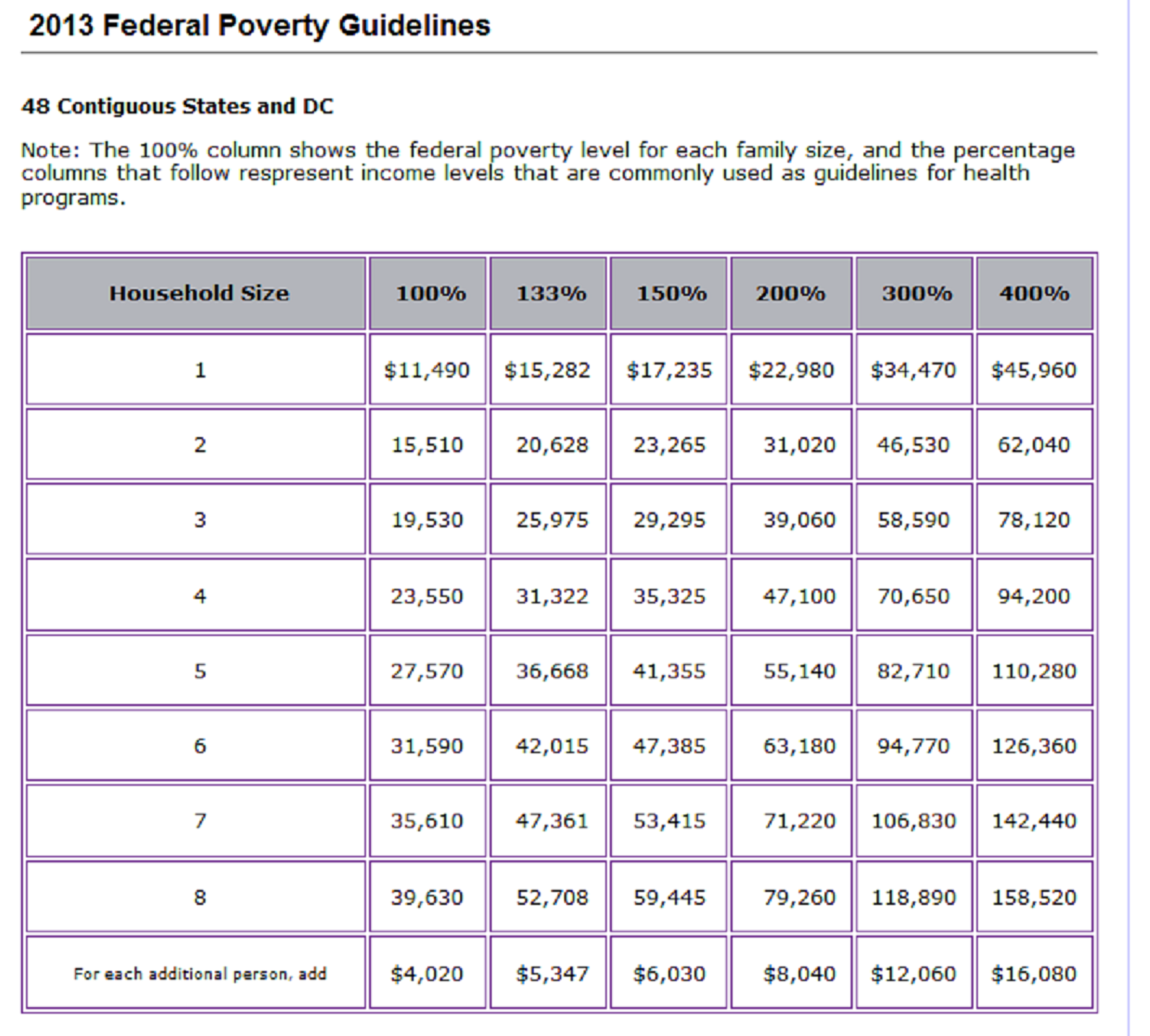

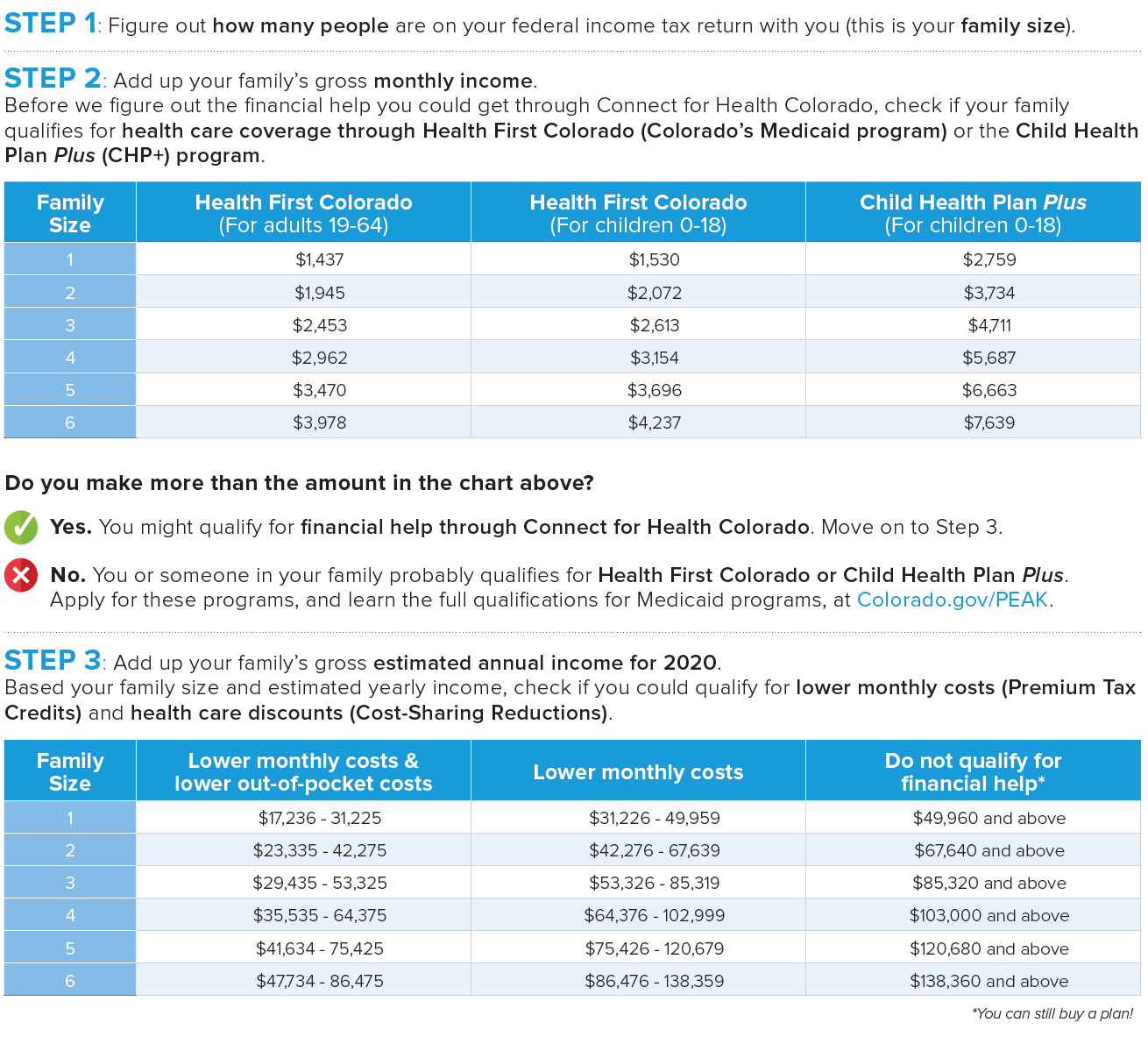

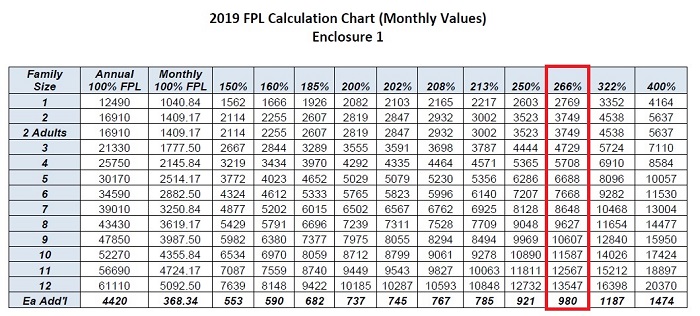

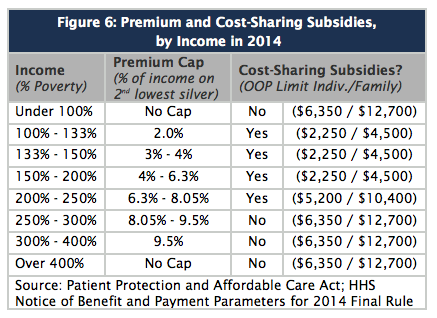

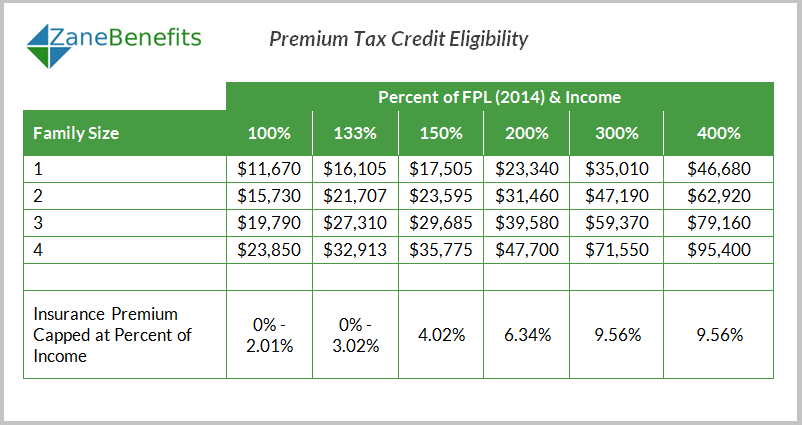

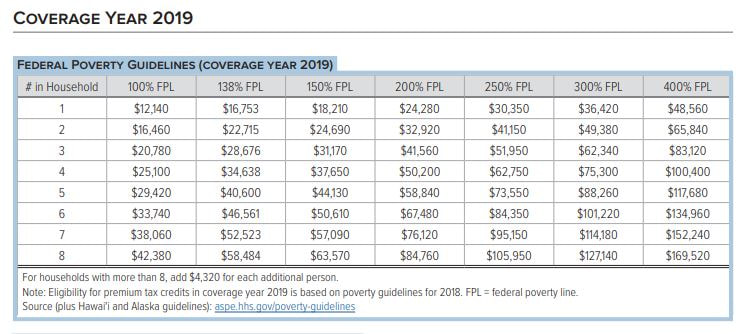

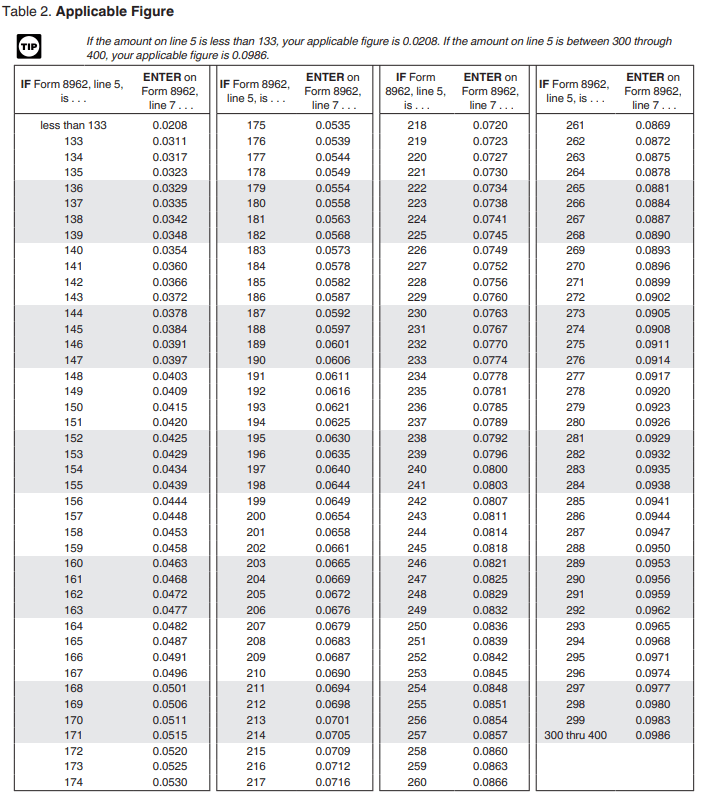

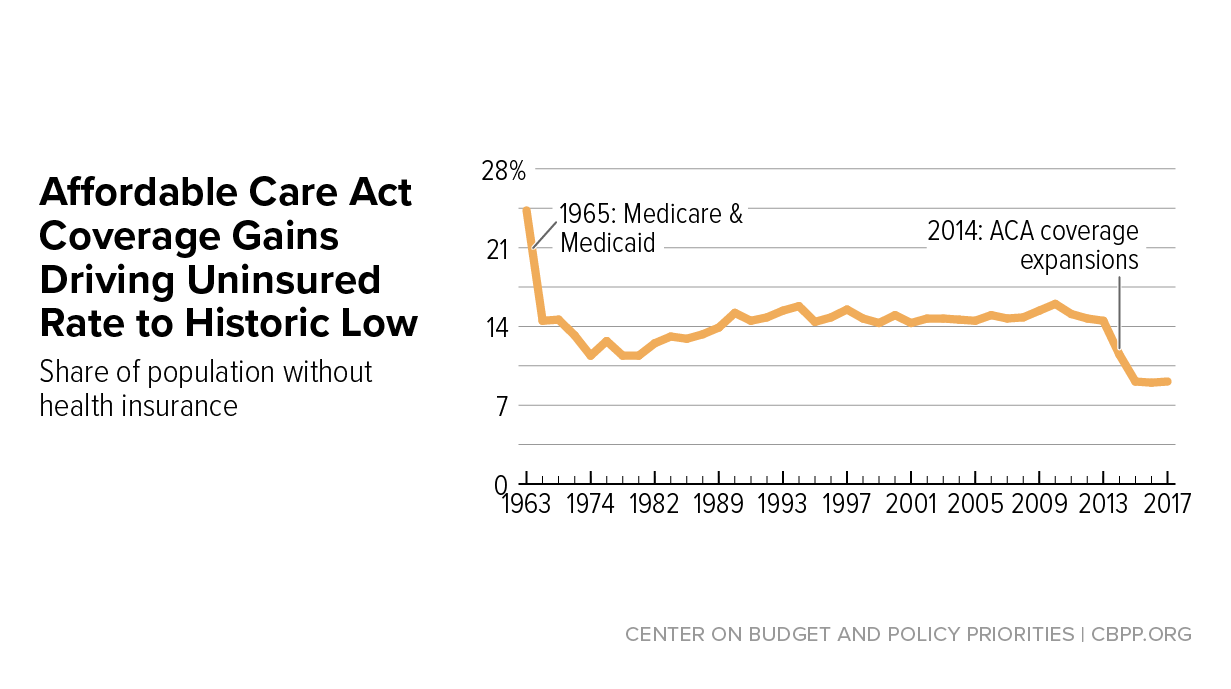

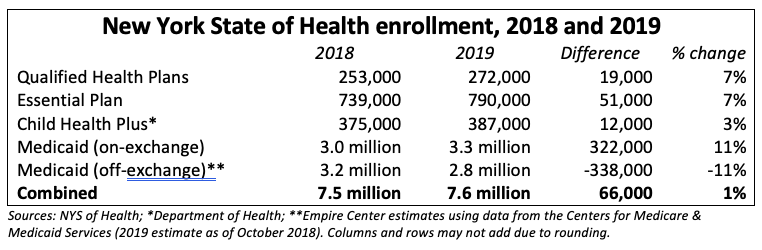

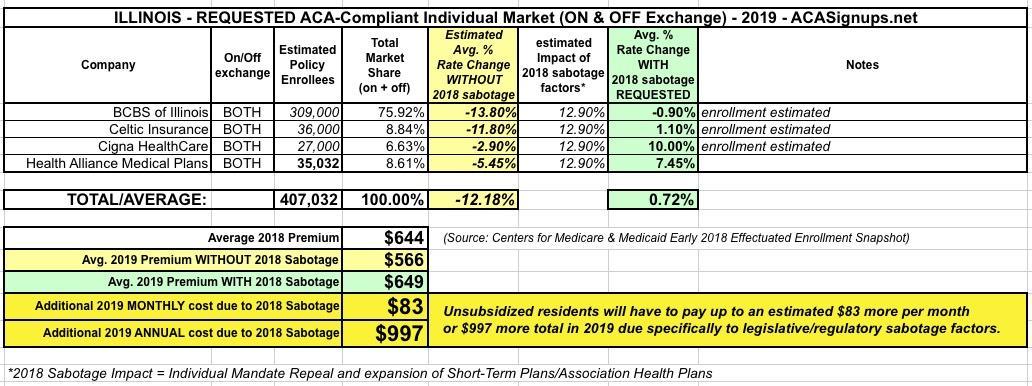

Obamacare income limits 2019 chart. The chart states that you are eligible for obamacare subsidies for 2019 if your household income is at least 100 higher than the percent of the fpl in 2018 or in other terms. Start with your household s adjusted gross income agi from your most recent federal income tax return. The chart states that you are eligible for obamacare subsidies for 2019 if your household income is at least 100 higher than the percent of the fpl in 2018 or in other terms.

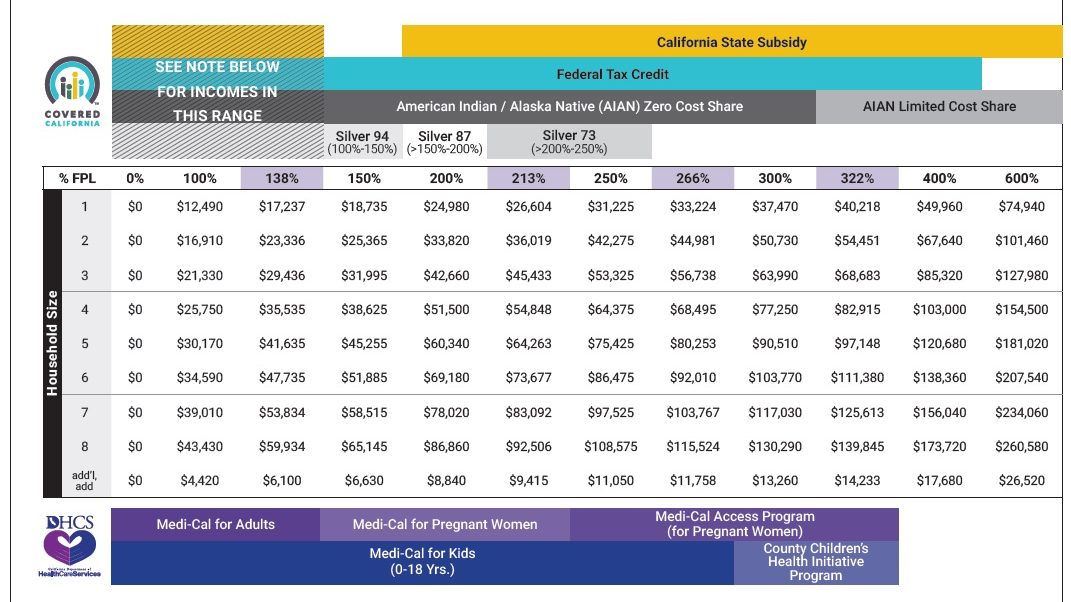

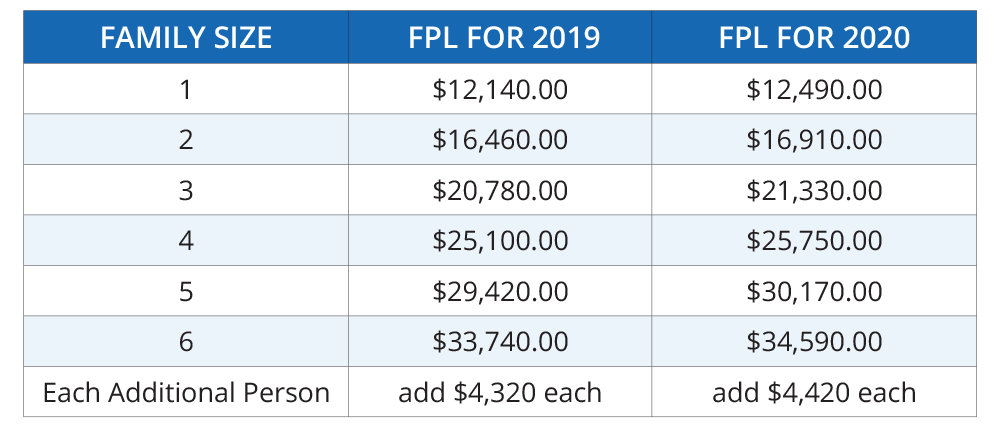

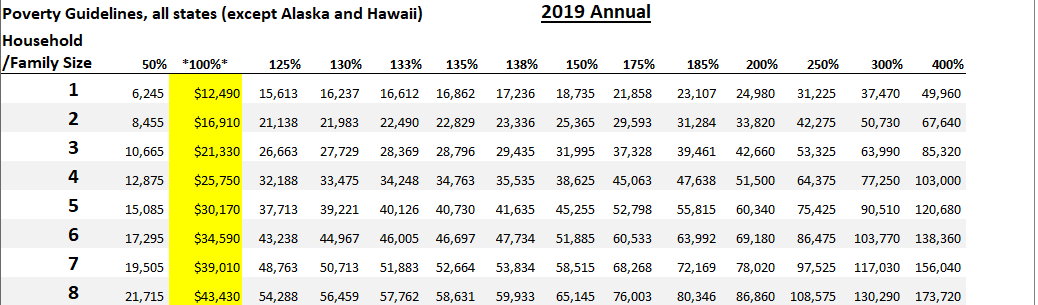

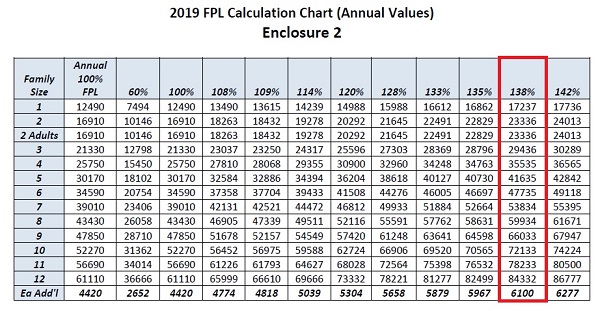

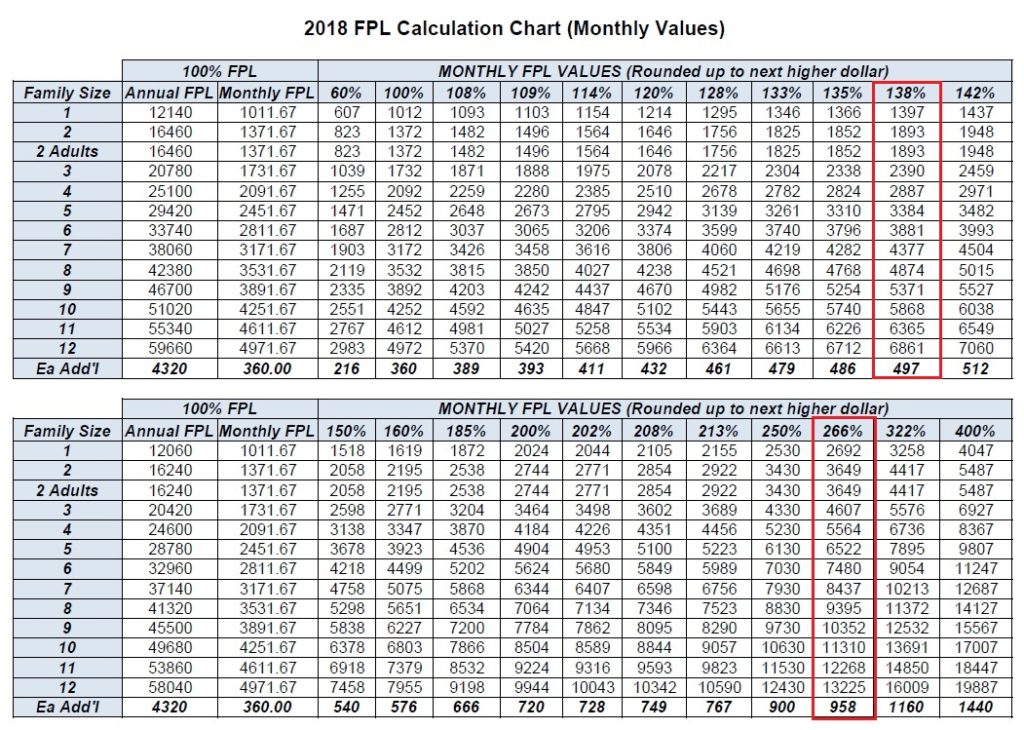

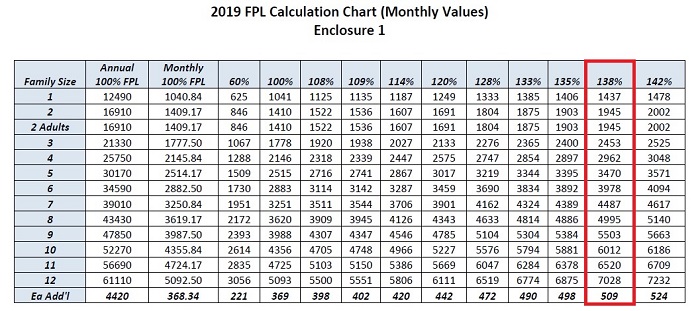

For the 2019 tax year that s line 8b on form 1040. For 2019 your maximum deductible is the same as the out of pocket maximum. Households with more than 8 people should add 4 420 per person.

An easy way to estimate your income is to start with your adjusted gross income from last year s tax return. Add the following kinds of income if you have any to your. Don t have recent agi.

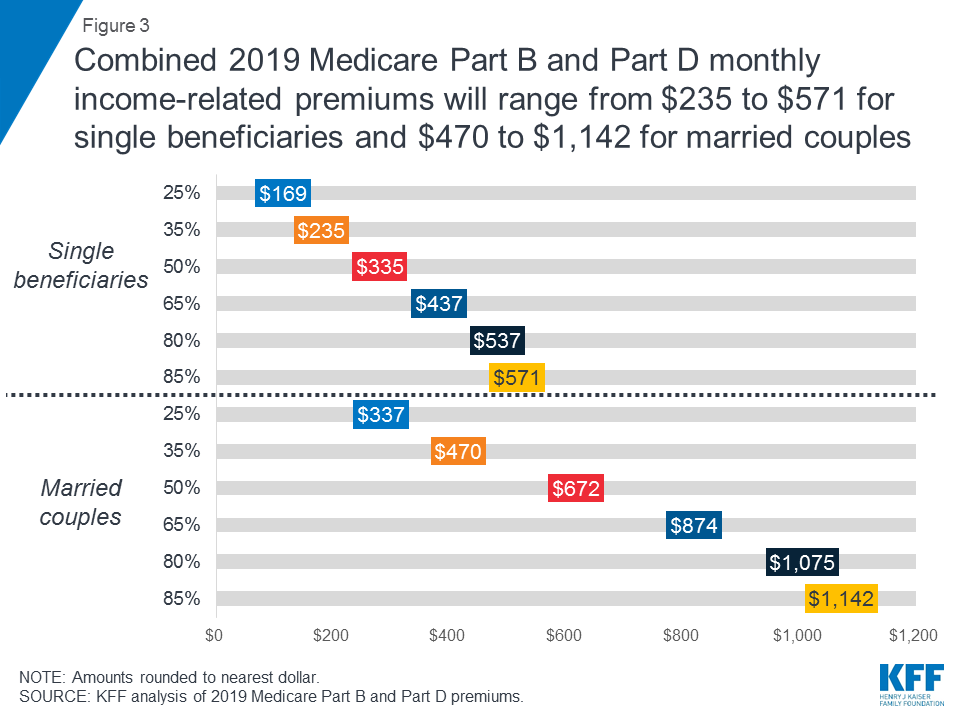

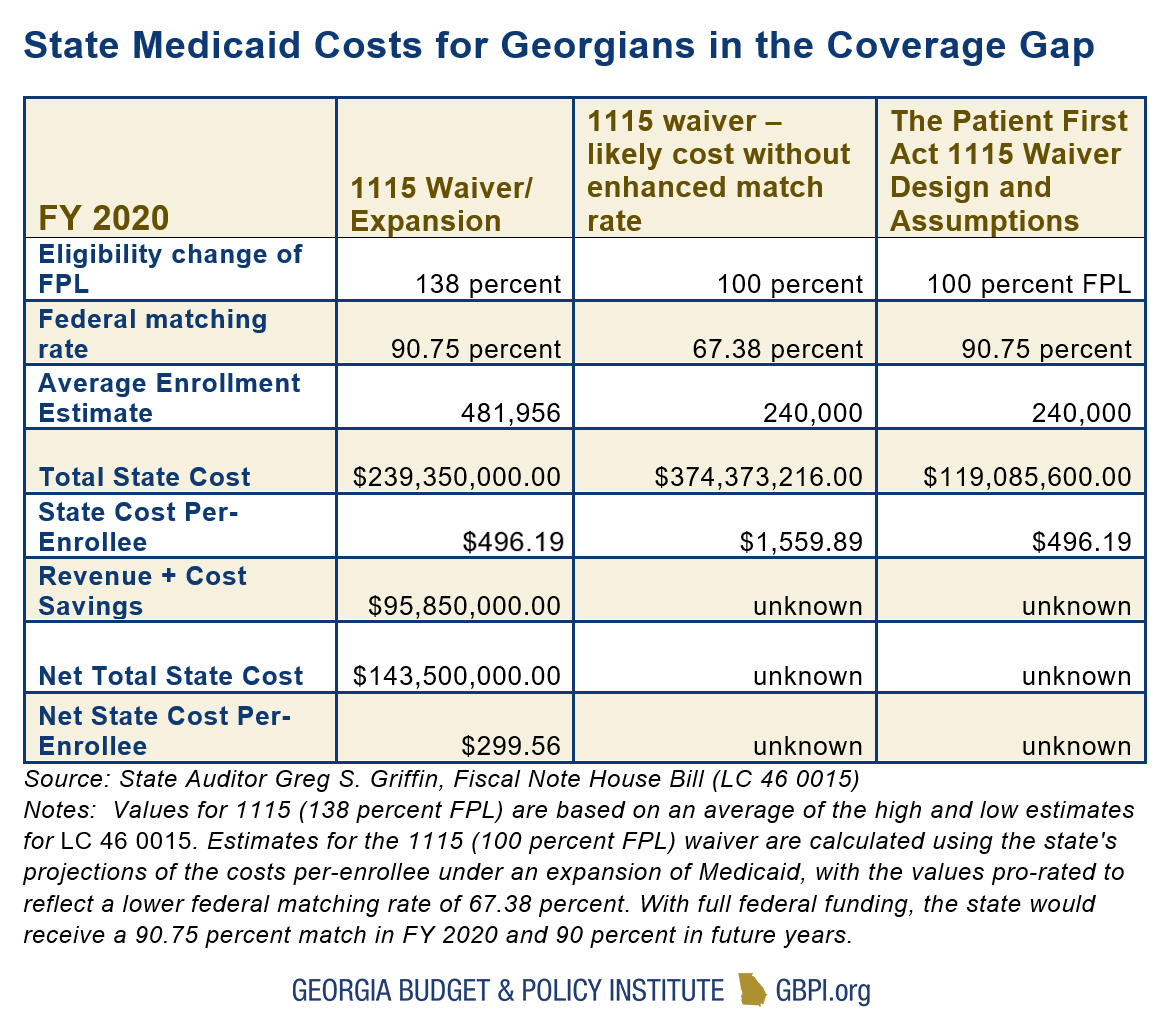

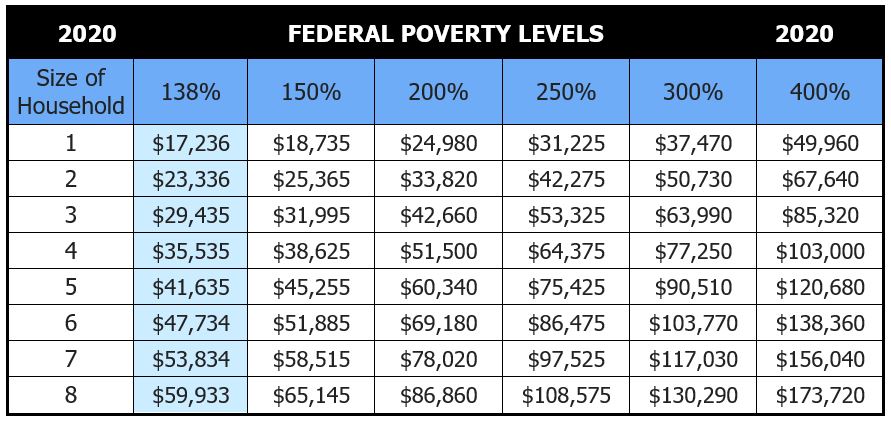

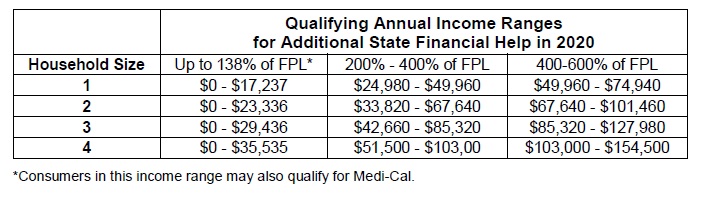

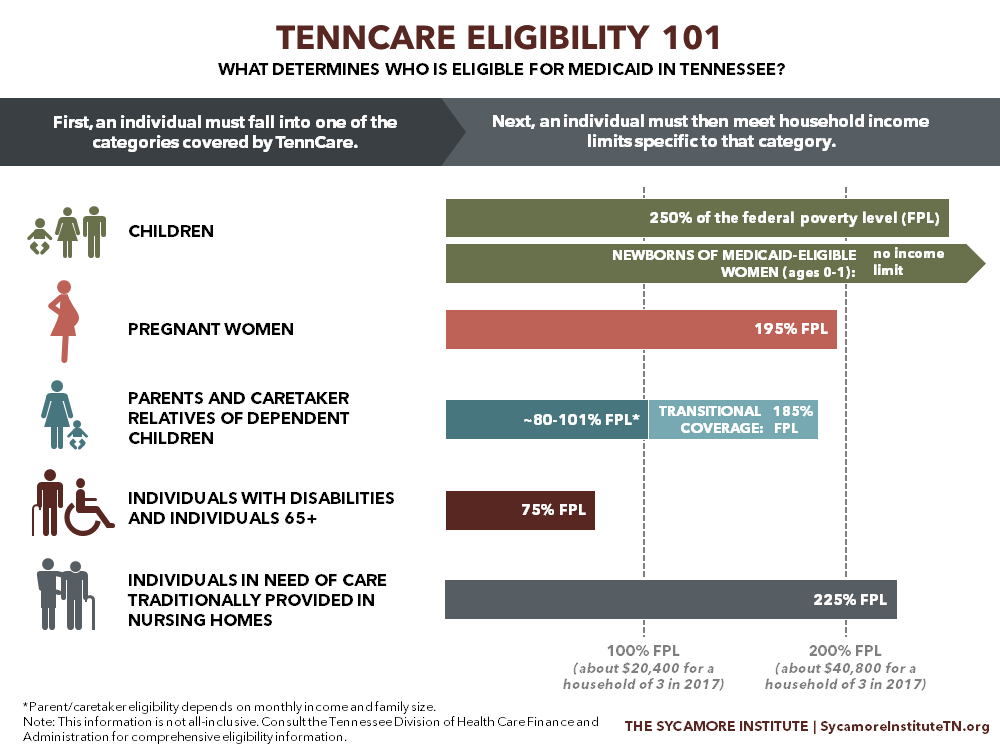

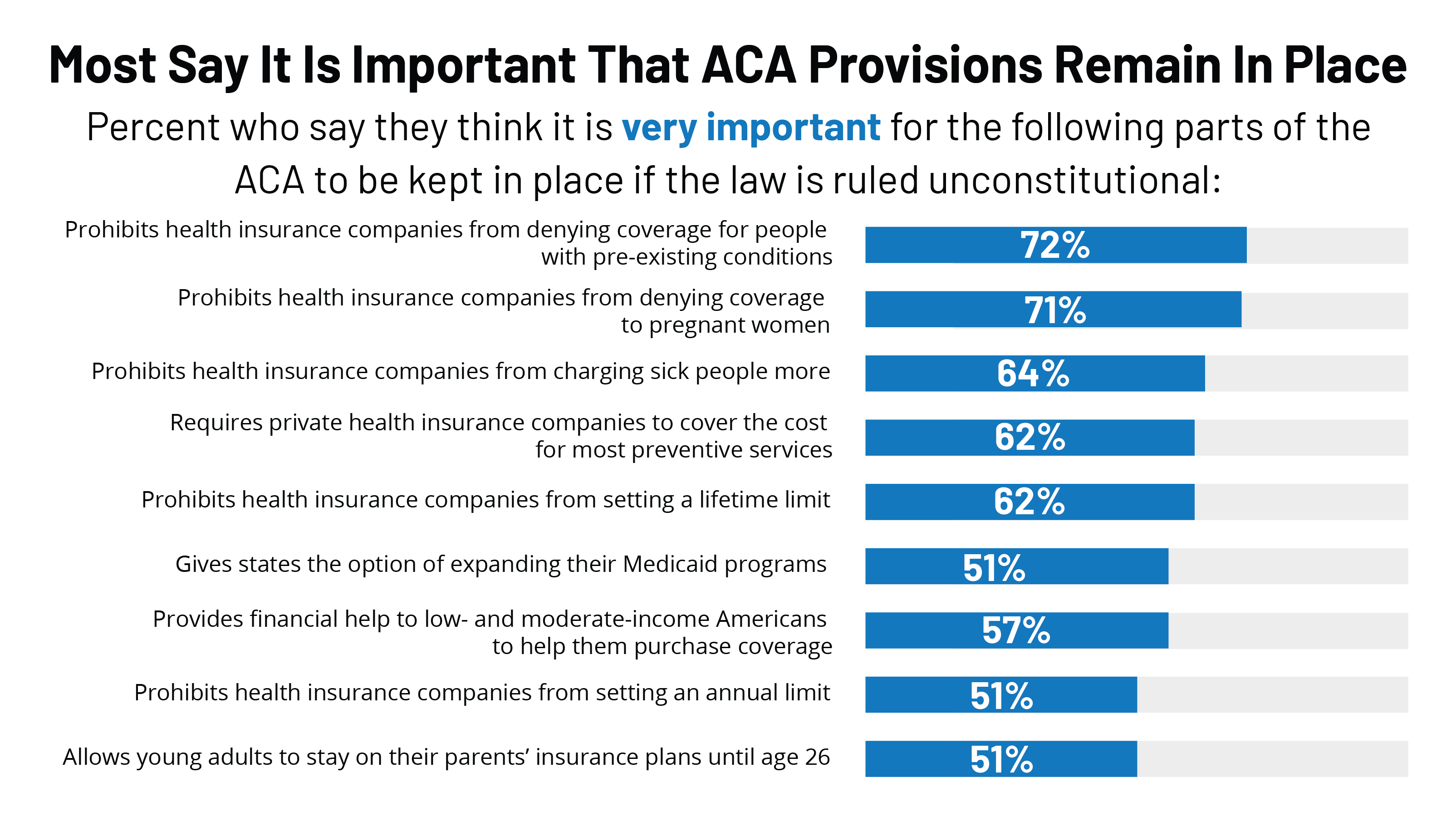

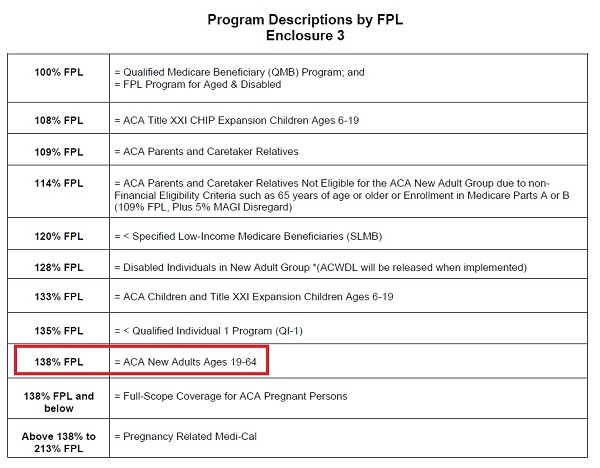

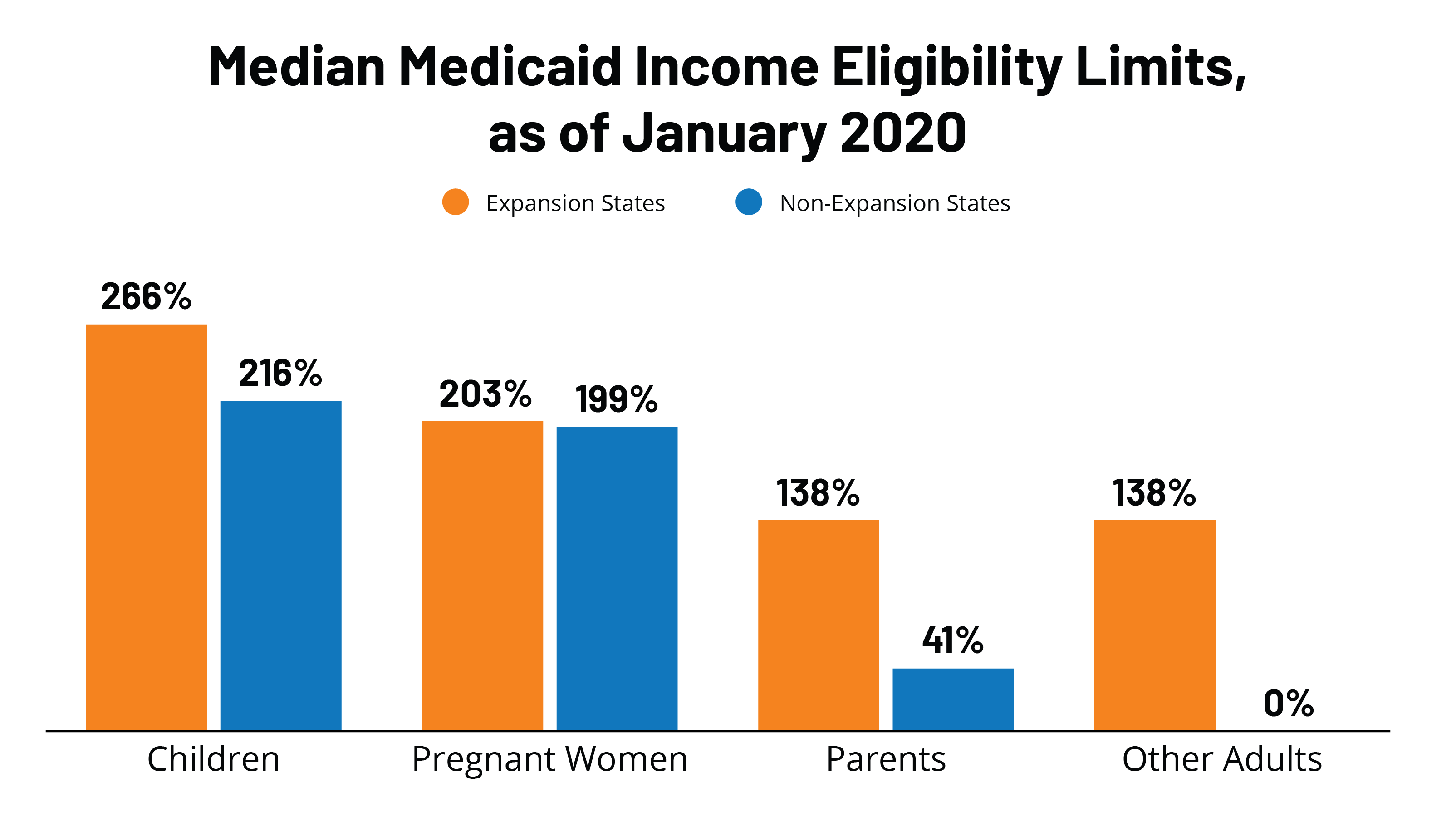

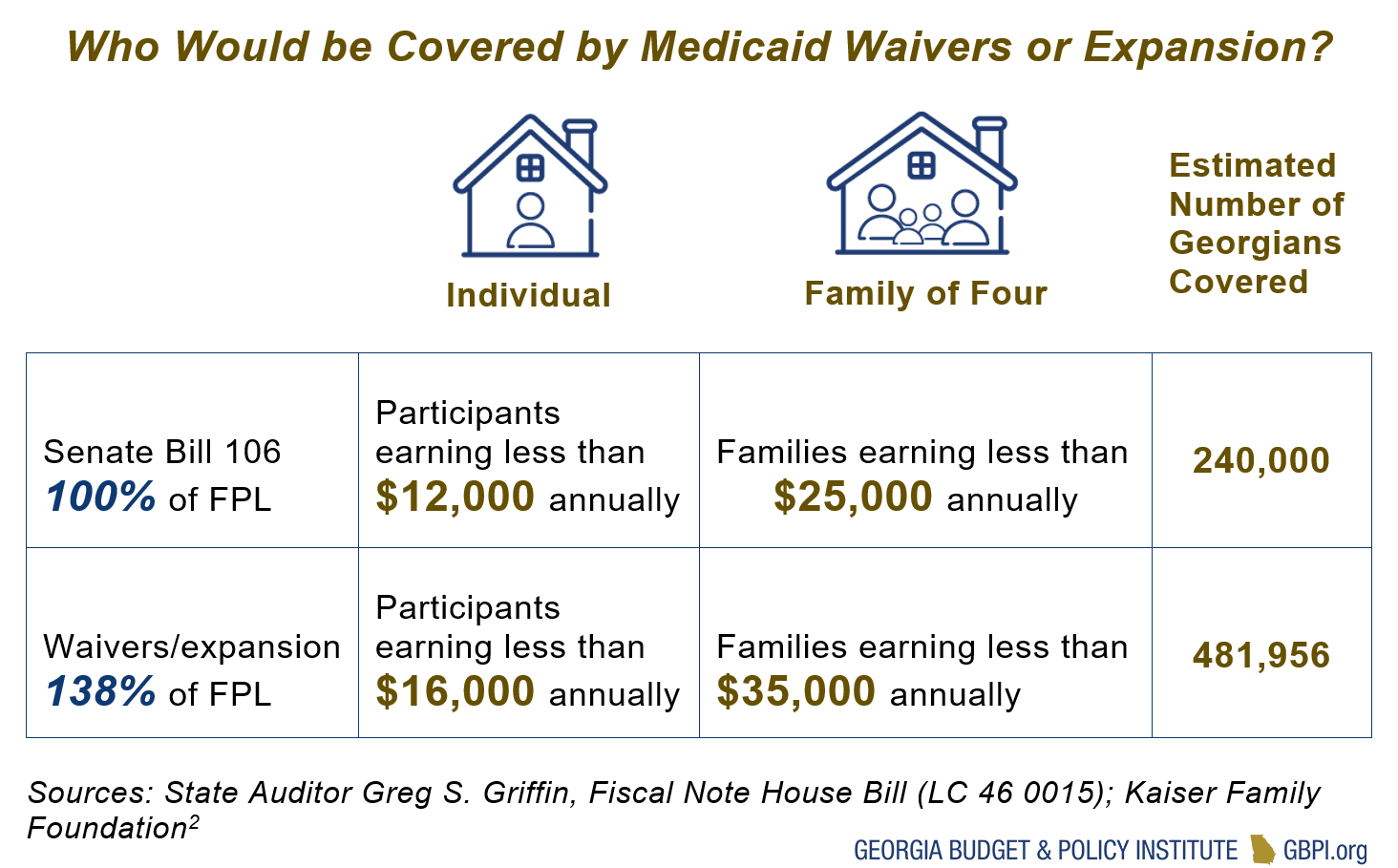

Minimum deductible for hsa eligibility. In states that have expanded medicaid a person qualifes for medicaid if one earns up to 138 percent of the fpl. The calculator spits out 0 subsidies which is a glitch implying such applicants pay 0 to next to nothing for annual health care premiums.

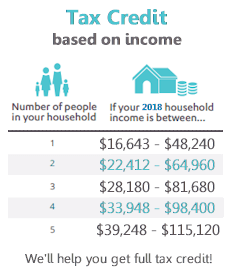

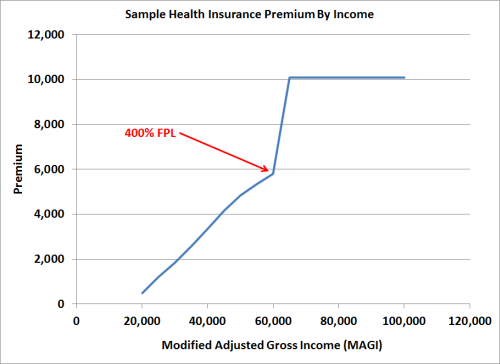

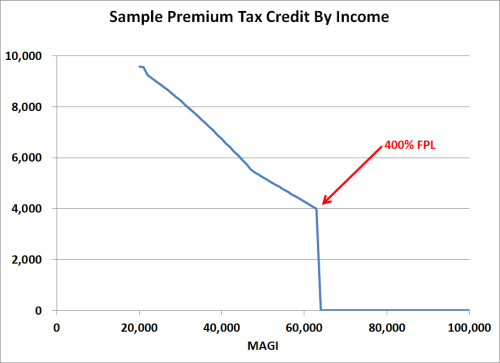

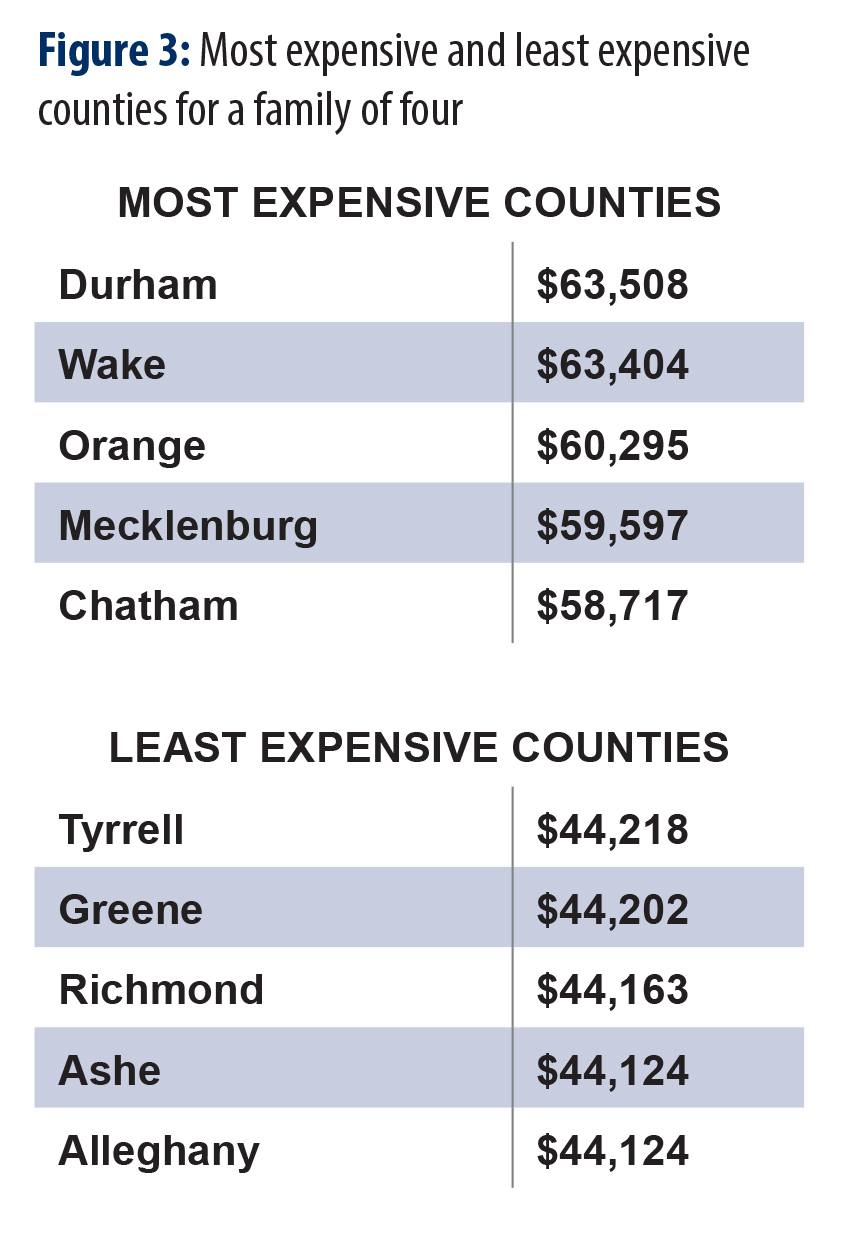

For 2019 your out of pocket maximum can be no more than 7 900 for an individual plan and 15 800 for a family plan before marketplace subsidies. Higher than 20 780 and lower than 83 120. Higher than 12 140 and lower than 48 560.

Higher than 16 460 and lower than 65 580. How to make an estimate of your expected income. Estimating your expected household income for 2020.

You ll find your agi on line 7 of irs form 1040. For a single individual in 2017 the upper income limit for medicaid eligibility was 16 642 and for a family of four the upper income limit was 33 948. Income under 25 100 to be exact for a family of four two adults two children 20 780 for a family of three and 12 140 for an individual are considered poverty levels in the united states.

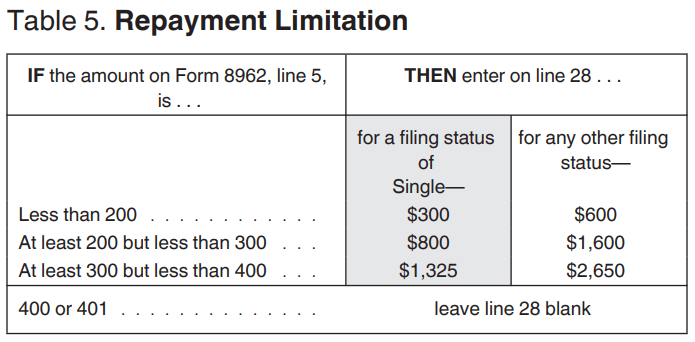

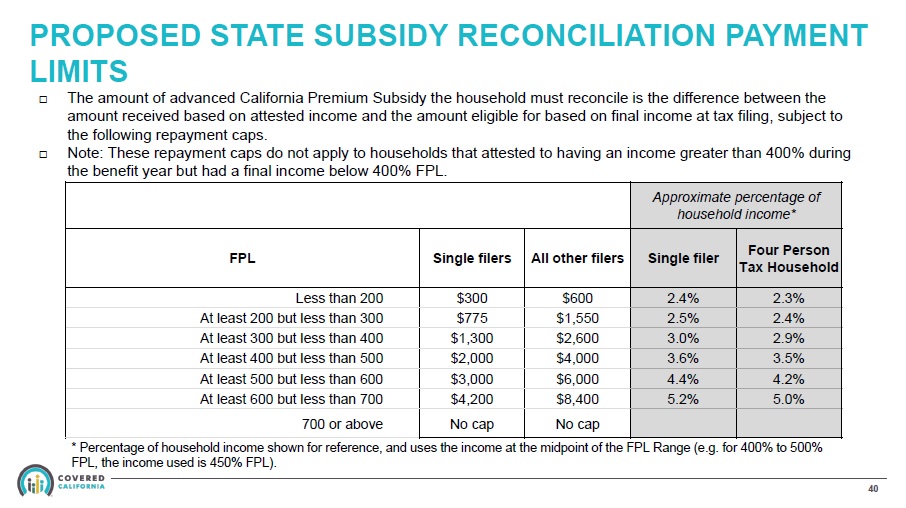

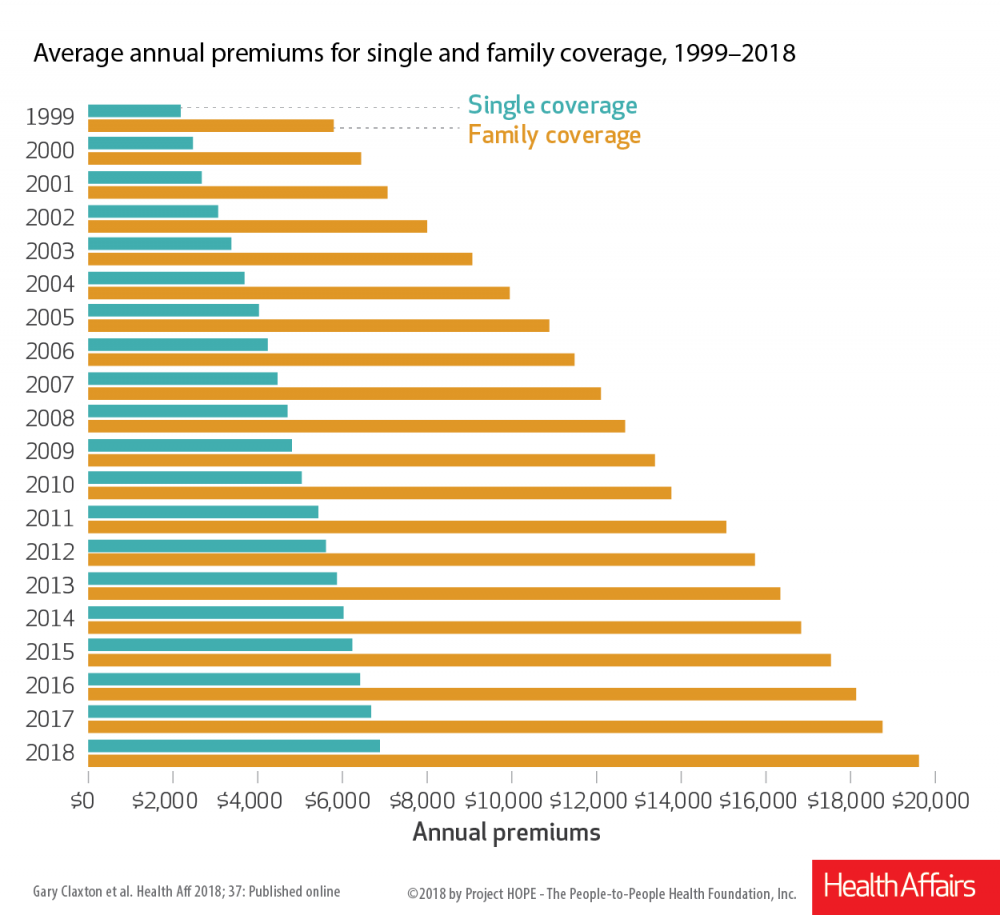

Savings are based on your income estimate for the year you want coverage not last year s use our income calculator to make your best estimate. Analysis of income limits for subsidies poverty levels. You ll then need to add certain other income sources such as excluded foreign income nontaxable social security benefits and tax exempt interest if you have them most people don t.

Higher than 16 460 and lower than 65 580. Higher than 12 140 and lower than 48 560.

.jpg)

:max_bytes(150000):strip_icc()/how-much-will-obamacare-cost-me-3306054-v3-5bbd183246e0fb0051d2593b.png)