Tax Brackets 2018 Chart

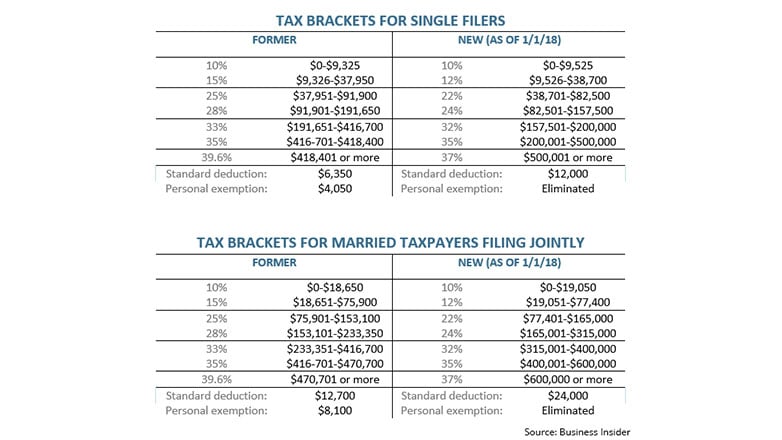

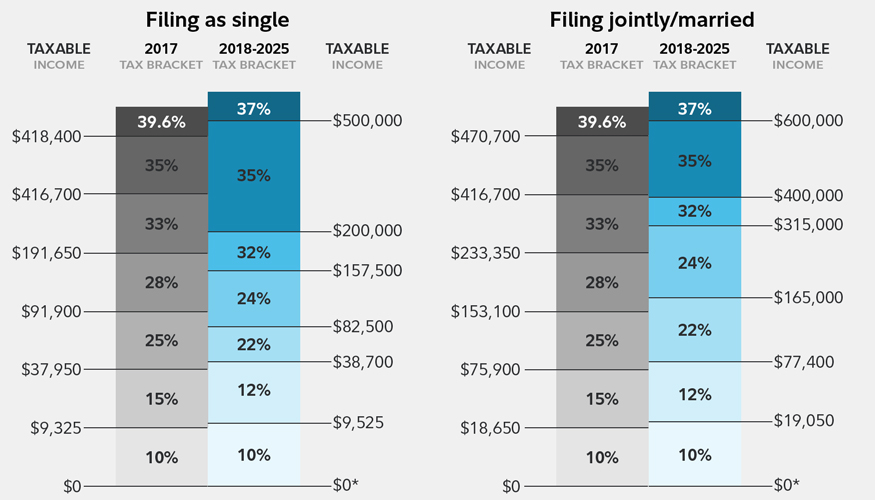

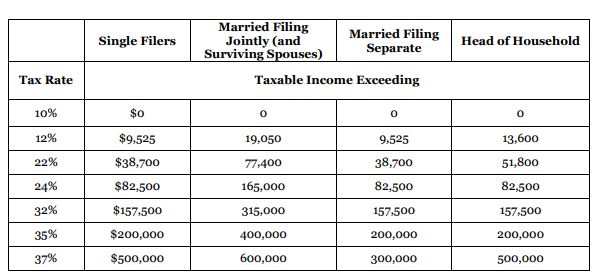

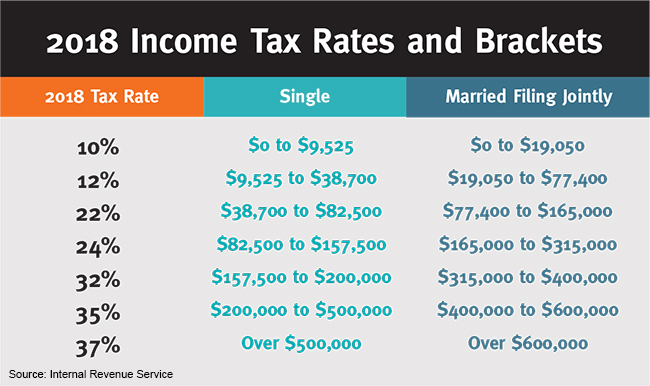

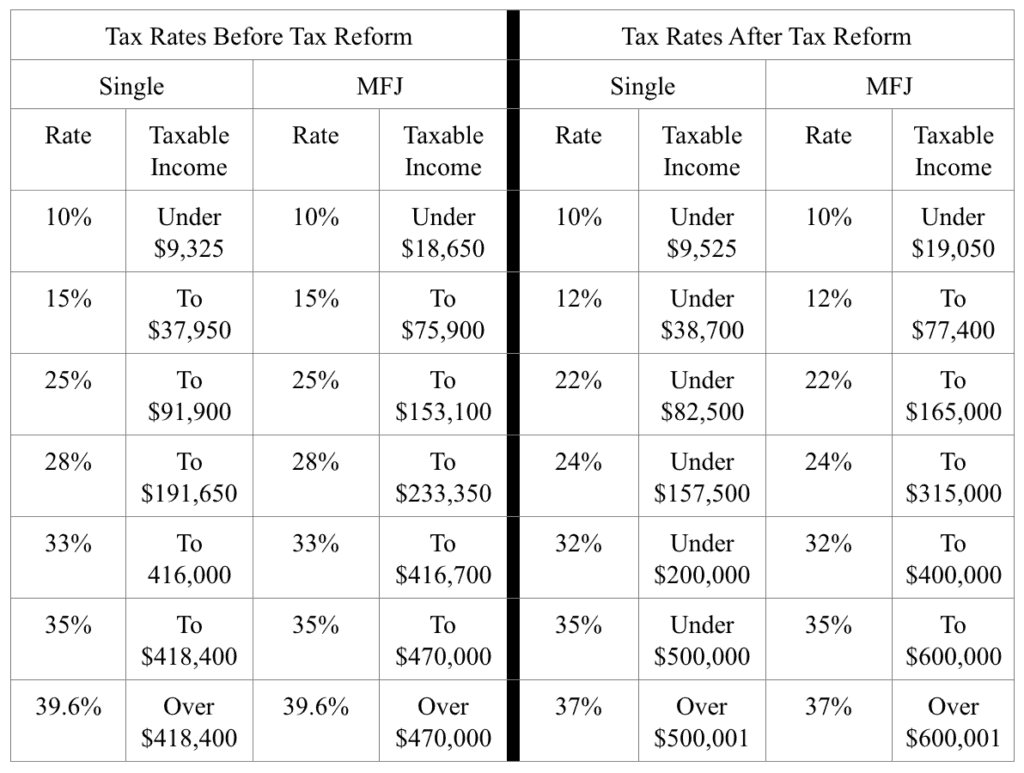

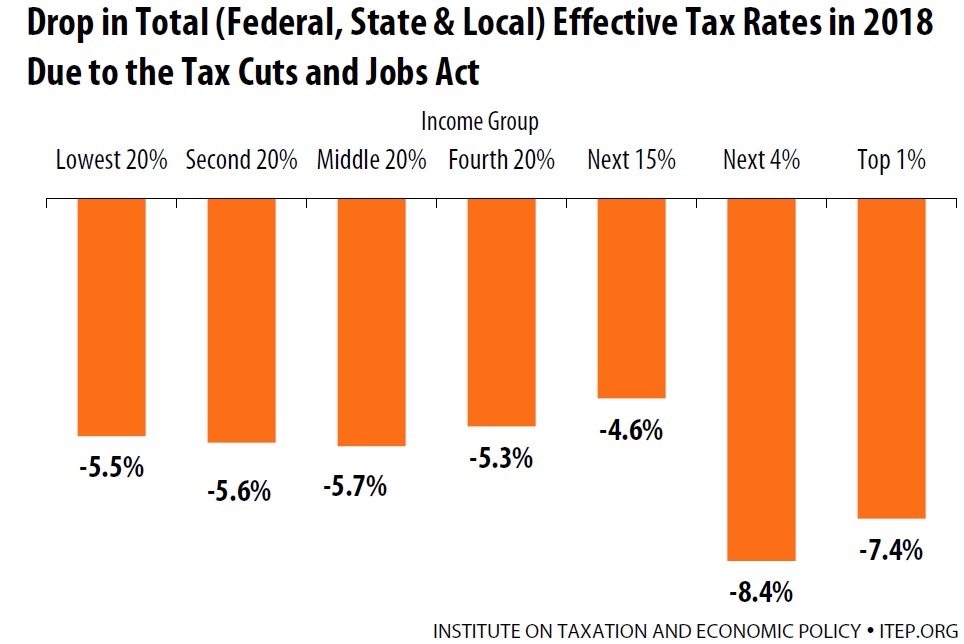

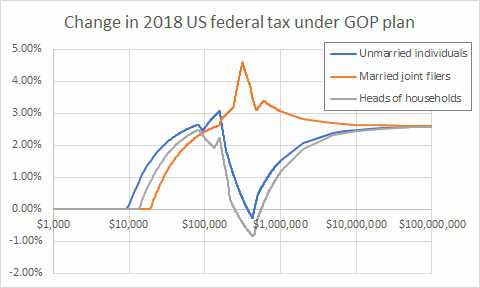

The chart below shows the tax brackets from the republican tax plan.

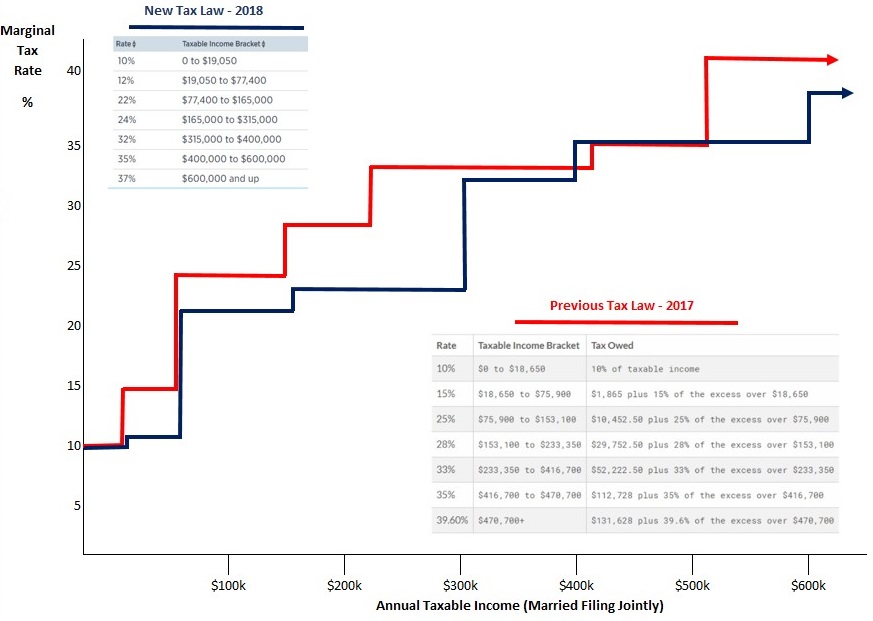

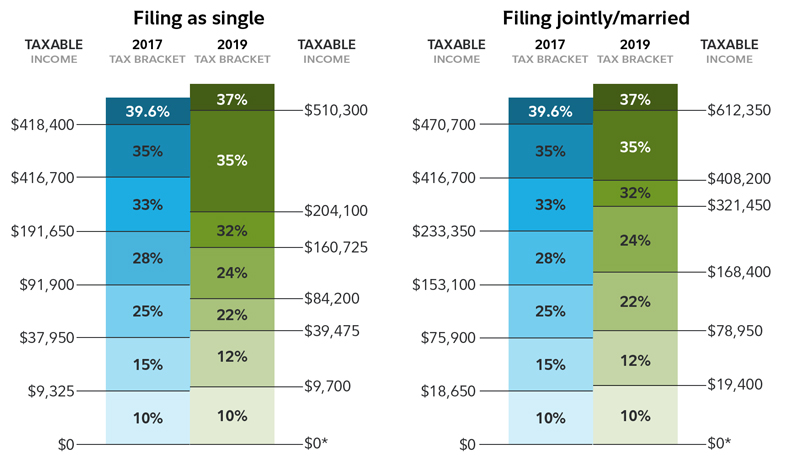

Tax brackets 2018 chart. The trump tax brackets. In march 2018 the irs issued the official 2018 brackets standard deductions and other amounts including phaseouts and credits. The top marginal income tax rate of 37 percent will hit taxpayers with taxable income of 500 000 and higher for single filers and 600 000 and higher for married couples filing.

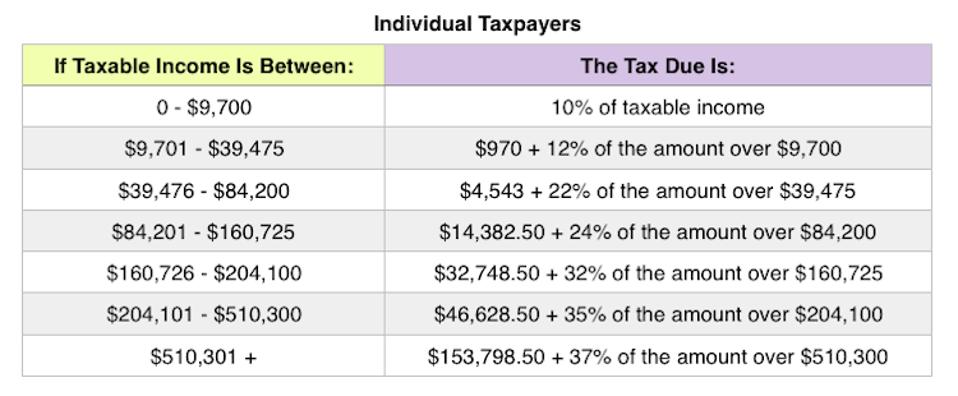

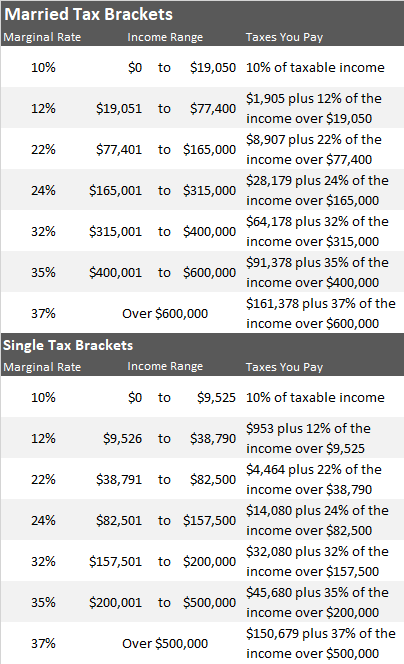

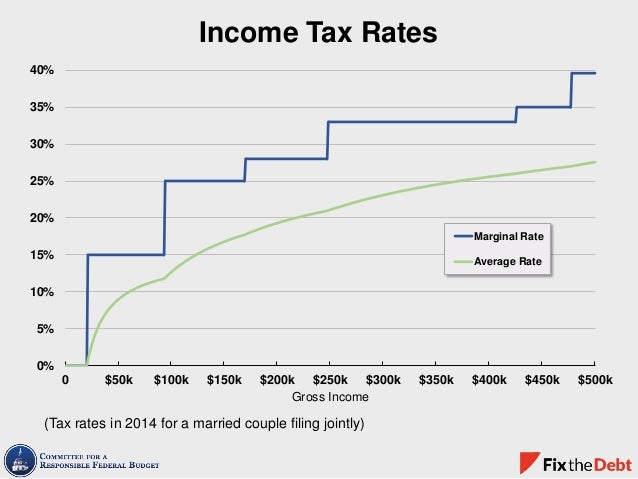

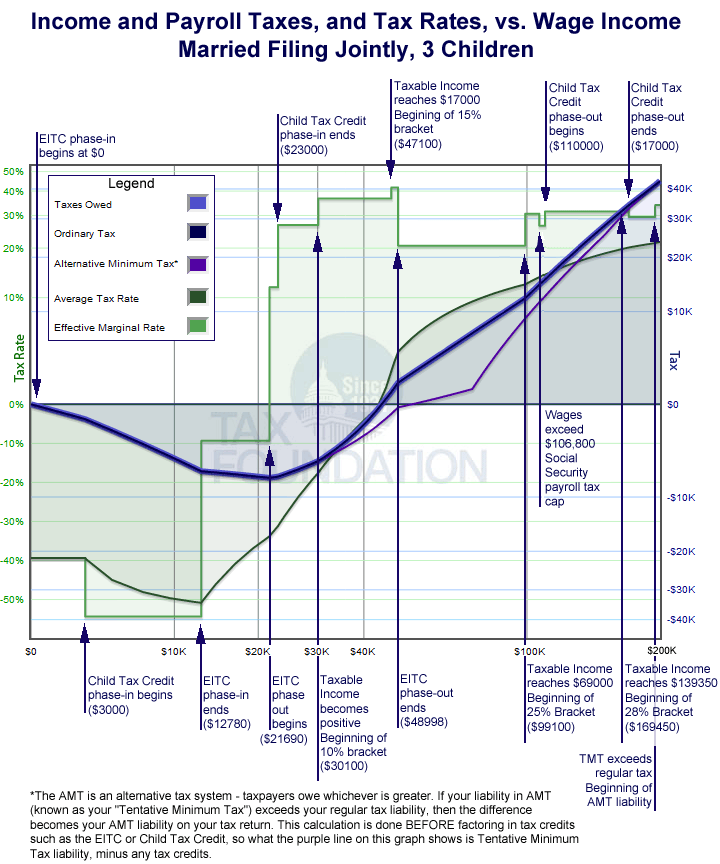

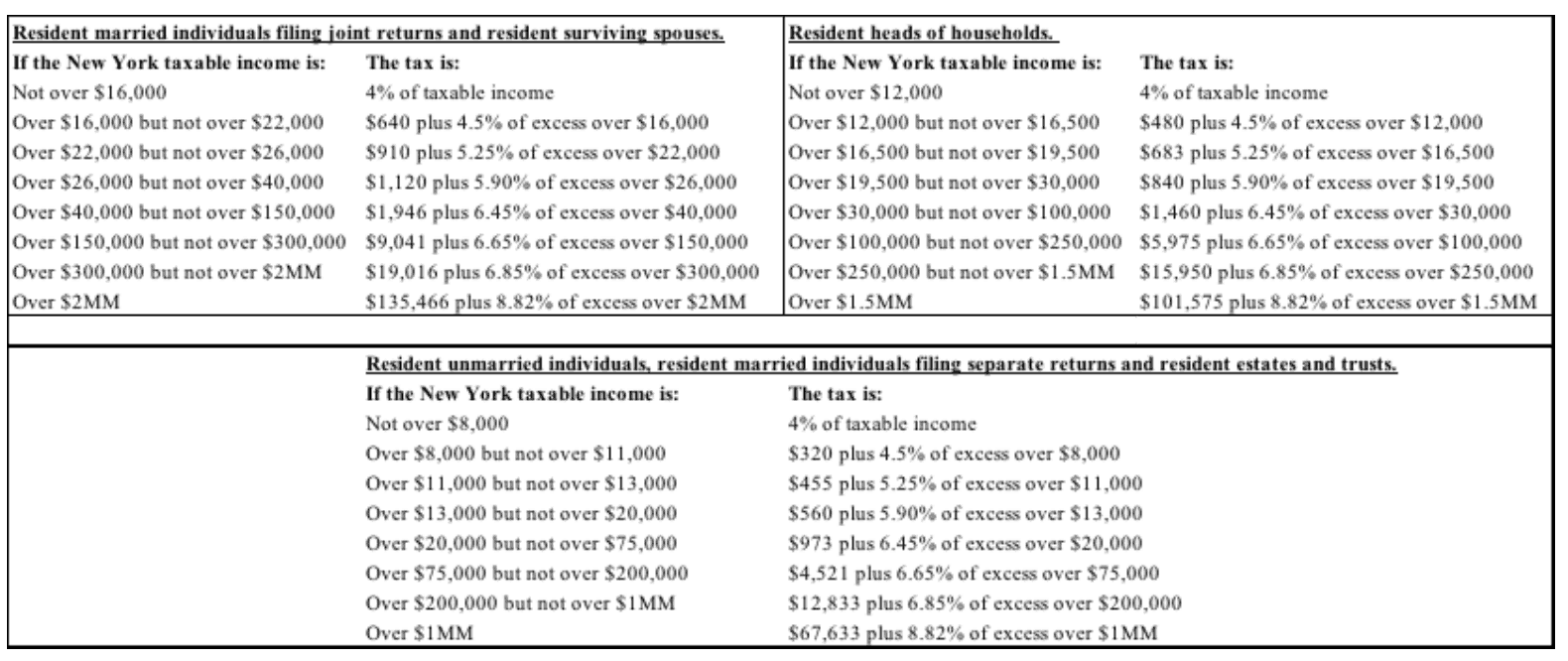

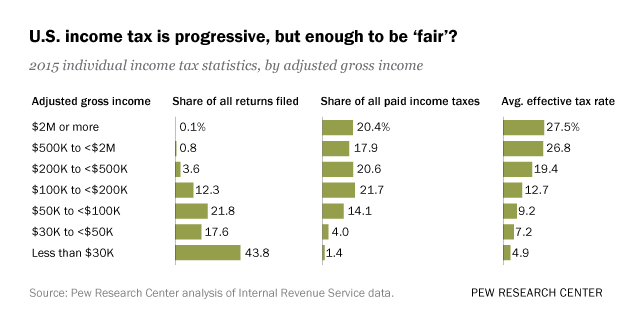

A separate tax must be computed for you and your spouse. The tax rate increases as the level of taxable income increases. The top marginal income tax rate of 37 percent will hit taxpayers with taxable income of 500 000 and higher for single filers and 600 000 and higher for married couples filing jointly.

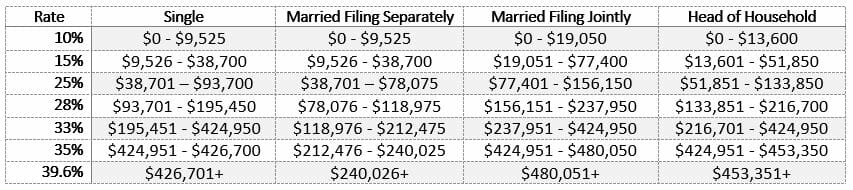

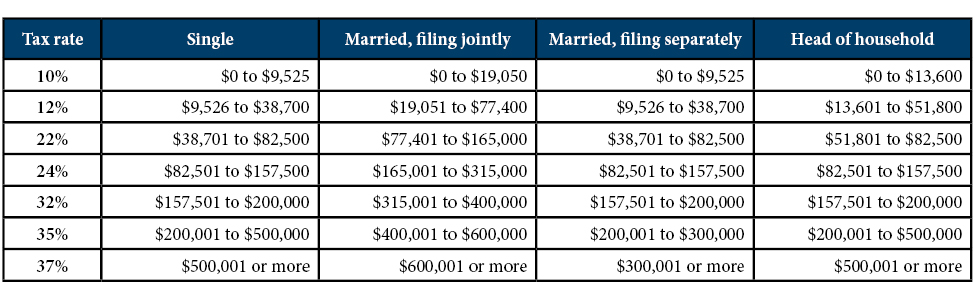

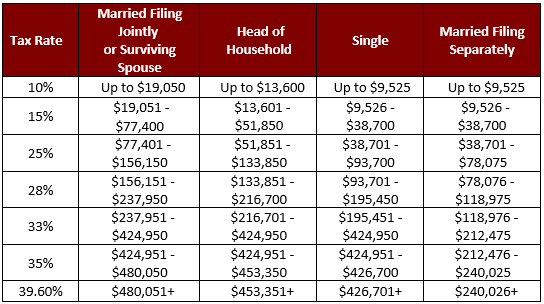

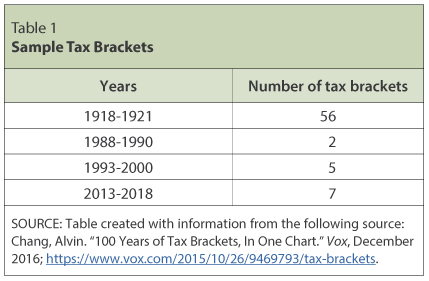

10 percent 12 percent 22 percent 24 percent 32 percent 35 percent and 37 percent. There are seven federal tax brackets for the 2020 tax year. Income tax brackets and rates.

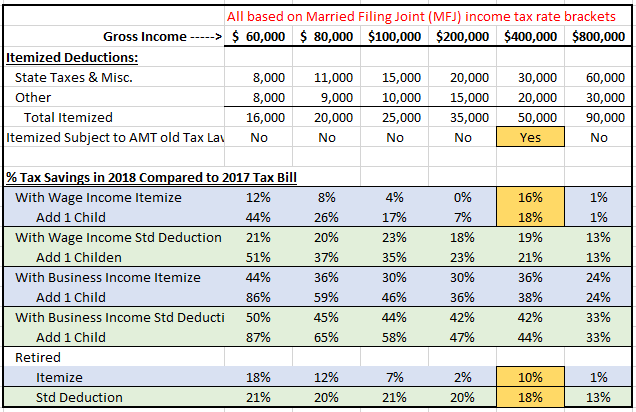

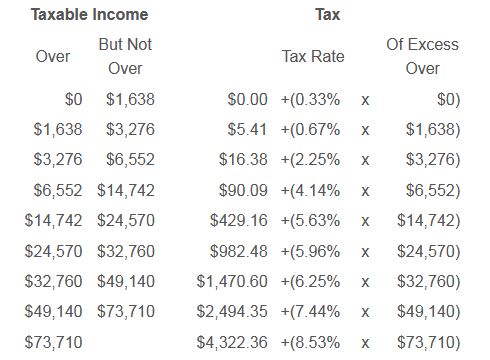

Use this tax bracket calculator to discover which bracket you fall in. It appears the gop has settled on a final tax bill. The inland revenue service irs is responsible for publishing the latest tax tables each year rates are typically published in 4 th quarter of the year proceeding the new tax year.

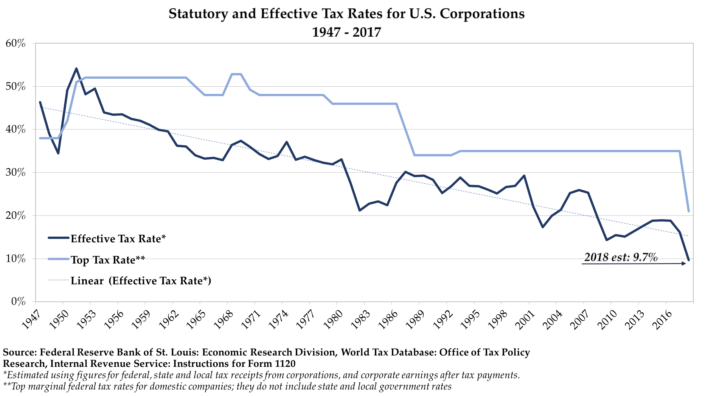

The 2019 tax rate ranges from 10 to 37. Federal income tax brackets were last changed one year ago for tax year 2019 and the tax rates were previously changed in 2018 federal tax brackets are indexed for inflation and are updated yearly to reflect changes in cost of living. There are seven tax brackets for most ordinary income.

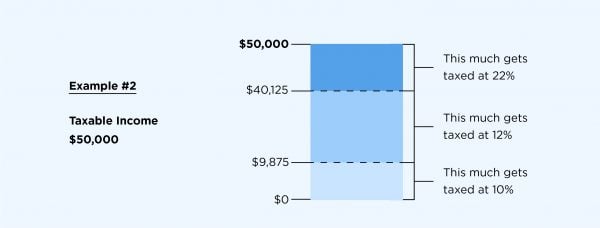

The united states internal revenue service uses a tax bracket system. 10 12 22 24 32 35 and 37. Being in a higher tax bracket doesn t mean all of your income is taxed at that rate.

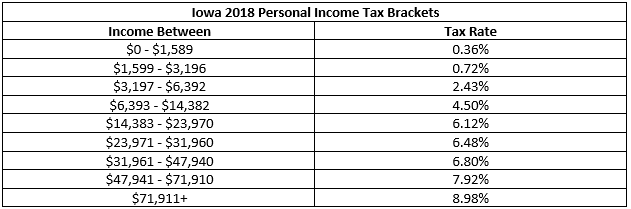

Your bracket depends on your taxable income and filing status. This page provides detail of the federal tax tables for 2018 has links to historic federal tax tables which are used within the 2018 federal tax calculator and has supporting links to each set of state tax tables. If you know your yearly income you can figure out your tax bracket and see what your rate is for your 2019 and 2020 taxes.

In 2018 the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows tables 1 and 2. Has a progressive tax system which means that. 2 enter the minimum taxable income for your tax bracket see section a above.

:max_bytes(150000):strip_icc()/2016-Federal-Tax-Rates-57a631ca3df78cf459194b33.png)

/TaxRates2-dc0366d01dd0491b91a1c3c93b4740db.jpg)

/cdn.vox-cdn.com/uploads/chorus_image/image/59407005/Screen_Shot_2018_04_09_at_12.56.42_PM.0.png)

/cdn.vox-cdn.com/uploads/chorus_asset/file/19335983/Screen_Shot_2019_10_31_at_3.30.19_PM.png)